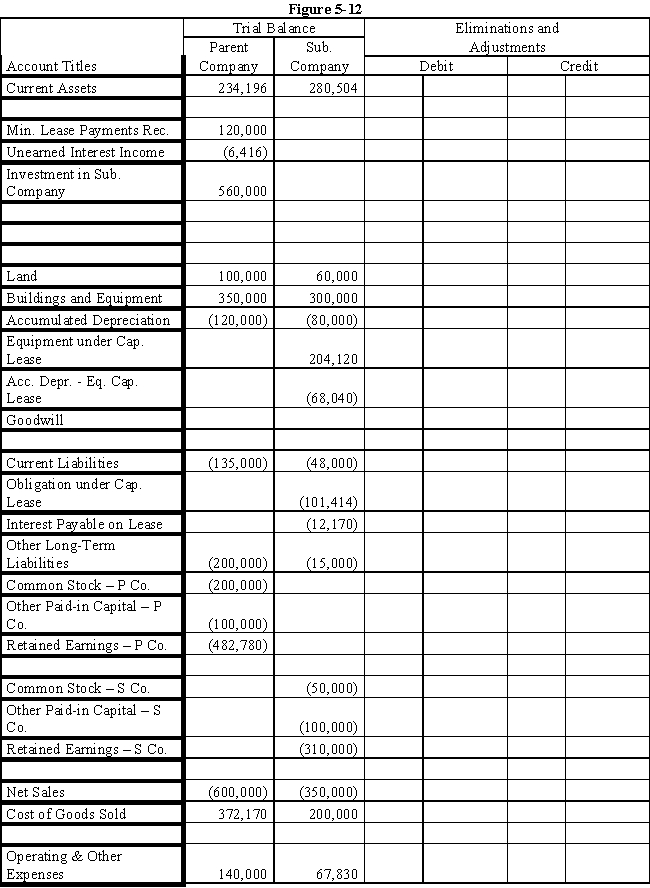

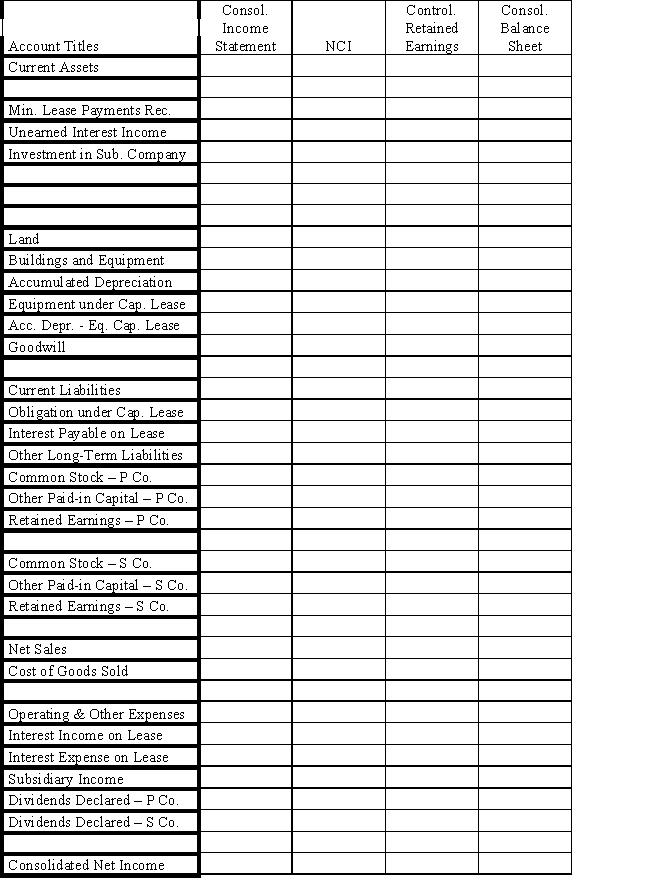

On January 1, 2016, Parent Company purchased 100% of the common stock of Subsidiary Company for $390,000.On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively.Any excess of cost over book value is due to goodwill.Parent accounts for the Investment in Subsidiary using the simple equity method.

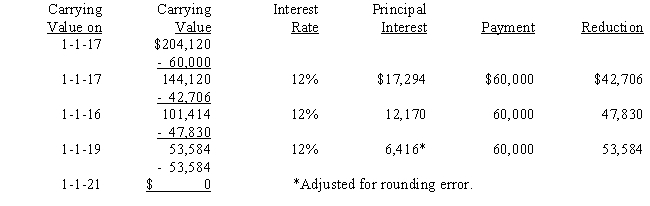

On January 1, 2017, Parent purchased equipment for $204,120 and immediately leased the equipment to Subsidiary on a 4-year lease.The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments.The implicit interest rate is 12%.The lease provides for an automatic transfer of title at the end of 4 years.The estimated useful life of the equipment is 6 years.The lease has been capitalized by both companies.

A lease amortization schedule, applicable to either company, is presented below:

On January 1, 2016, Parent held merchandise acquired from Subsidiary for $10,000.During 2016, subsidiary sold merchandise to Parent for $50,000, of which $15,000 is held by Parent on December 31, 2016.Subsidiary's usual gross profit on affiliated sales is 40%.

On January 1, 2016, Parent held merchandise acquired from Subsidiary for $10,000.During 2016, subsidiary sold merchandise to Parent for $50,000, of which $15,000 is held by Parent on December 31, 2016.Subsidiary's usual gross profit on affiliated sales is 40%.

Required:

Complete the Figure 5-12 worksheet for consolidated financial statements for the year ended December 31, 2016.Round all computations to the nearest dollar.

Definitions:

Suburban Middle Class

A socio-economic class typically living in suburban areas, characterized by a moderate to high income level, home ownership, and a lifestyle that supports family and community activities.

Mature Foreign Films

Movies from countries other than one's own that are intended for an adult audience, often dealing with complex themes and situations.

Residuals

Royalties paid by contract to actors when their filmed work is aired on television or digital medium or when their television work is rerun or shown in syndication.

Negotiating Tool

A method or resource employed during negotiations to persuade or influence the outcome in one's favor.

Q2: One large bank's acquisition of another bank

Q4: Pete purchased 100% of the common

Q15: Under which of these circumstances will a

Q17: Company P Industries purchased a 70% interest

Q31: A greater percentage of Canadians belong to

Q31: Crystal Co.purchased all of the common stock

Q34: Supernova Company had the following summarized balance

Q39: If a company is utilizing LIFO inventory

Q41: During the Industrial Revolution, the use of

Q60: A fair value hedge may include hedges