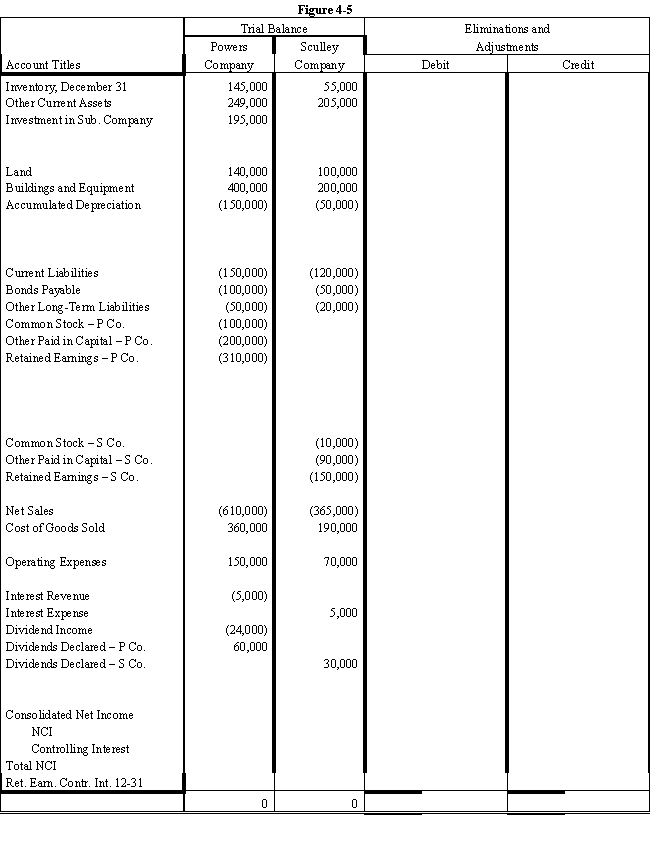

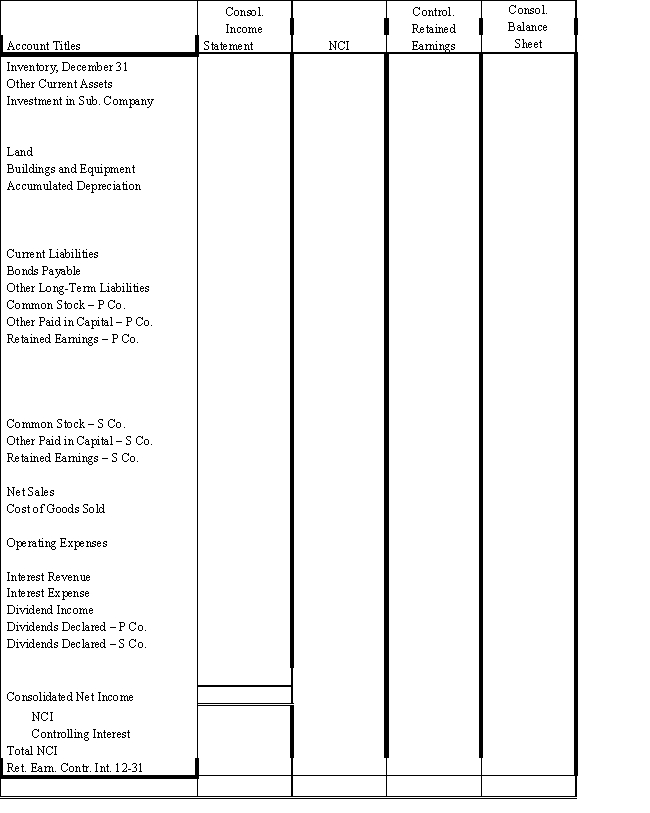

On January 1, 2016, Powers Company acquired 80% of the common stock of Sculley Company for $195,000.On this date Sculley had total owners' equity of $200,000 (common stock, other paid-in capital, and retained earnings of $10,000, $90,000, and $100,000 respectively).

?

Any excess of cost over book value is attributable to inventory (worth $6,250 more than cost), to equipment (worth $12,500 more than book value), and to patents.FIFO is used for inventories.The equipment has a remaining life of five years and straight-line depreciation is used.The excess to the patents is to be amortized over 20 years.

?

On July 1, 2017 Sculley borrowed $100,000 from Powers with a 10% 1-year note; interest is due at maturity.

?

On January 1, 2017, Powers held merchandise acquired from Sculley for $10,000.During 2017, Sculley sold merchandise to Powers for $50,000, $20,000 of which is still held by Powers on December 31, 2017.Sculley's usual gross profit on affiliated sales is 50%.

?

On December 31, 2016, Powers sold equipment to Sculley at a gain of $10,000.During 2017, the equipment was used by Sculley.Depreciation is being computed using the straight-line method, a five-year life, and no salvage value.

?

Both companies have a calendar-year fiscal year.

?

Assume that during 2016 and 2017, Powers has appropriately accounted for its investment in Sculley using the cost method.

?

Required:

?

a.Using the information above or on the Figure 4-5 worksheet, prepare a determination and distribution of excess schedule.?

?

b.Complete the Figure 4-5 worksheet for consolidated financial statements for the year ended December 31, 2017.?

?

?

?

?

?

Definitions:

Marketers

Professionals or organizations involved in promoting, selling, and distributing a product or service to consumers, including market research and advertising.

Profitable

Having a financial gain or beneficial outcome, especially after all expenses have been deducted.

Market Segments

Distinct groups of consumers within a market who share similar needs, desires, and characteristics, allowing for targeted marketing strategies.

Behavioral Segmentation Variable

Criteria used in market segmentation based on patterns of consumer behavior, such as purchasing habits or brand interactions, to tailor marketing strategies.

Q2: Success within the guild required all but

Q11: Forward Contracts:<br>Calculate the gain or loss to

Q13: On January 1, 2016, Patrick Company

Q16: T & U form a partnership with

Q24: SEIU plans to organize workers in every

Q30: Voluntary recognition means the employer can argue

Q31: The Oral History Project has been a

Q35: Cozzi Company is being purchased and

Q38: Company P owns 80% of Company S.On

Q71: Rhante is a German company wholly