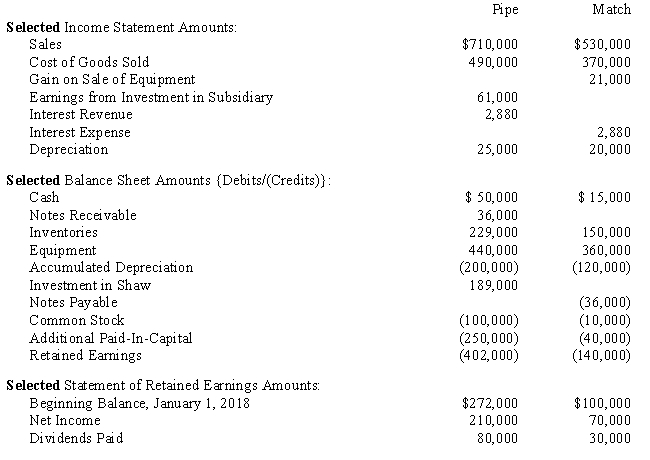

Account balances are as of December 31, 2018 except where noted.

?

?

Additional Information:

Additional Information:

?

On January 2, 2018 Pipe purchased 90% of Match for $155,000.On that date Match's shareholders' equity equaled $150,000 and the fair values of Match's assets and liabilities equaled their carrying amounts.Excess, if any, is attributed to patents and is amortized over 10 years.

?

On September 4, 2018 Match paid cash dividends of $30,000.

?

On January 3, 2018 Match sold equipment with an original cost of $30,000 and a carrying value of $15,000 to Pipe for $36,000.The equipment had a remaining useful life of 3 years.Straight-line depreciation is used.

?

On January 4, 2018 Match signed an 8% Note Payable.All interest payments were made as of December 31, 2018.

?

During the year Match sold merchandise to Pipe for $60,000, which included a profit of $20,000.At year end 50% of the merchandise remained in Pipe's inventory.

?

Required:

?1.Which method is Pipe using to account for the investment in Match? How do you know?

2.What elimination entry(ies) are associated with the elimination of intercompany profits due to the sale of merchandise?

3.What elimination entry(ies) are necessary with the sale of equipment by Match to Pipe?

4.What elimination entry(ies) are associated with the note to Match? Why are the entry(ies) made?

Definitions:

Urine

Fluid that consists of water and soluble wastes; formed and excreted by the vertebrate kidneys.

Urination

The process of excreting urine from the urinary bladder through the urethra to the outside of the body, an essential function for eliminating waste.

Filtration

A process that separates solids from liquids or gases using a filter medium that only allows the fluid to pass through.

Reabsorption

The process by which substances are taken back into the bloodstream from the fluids in the kidneys.

Q1: When examining the system put forward by

Q7: Power Company owns a 70% controlling

Q8: The SEC requires the use of push-down

Q31: The Oral History Project has been a

Q34: Ansfield, Inc.has several potentially reportable segments.The

Q37: The Winnipeg General Strike of 1919 saw

Q42: In some Canadian jurisdictions, the labour relations

Q49: It is possible for segments to qualify

Q54: Complete the following worksheet, assuming that

Q75: Assuming that a foreign entity is deemed