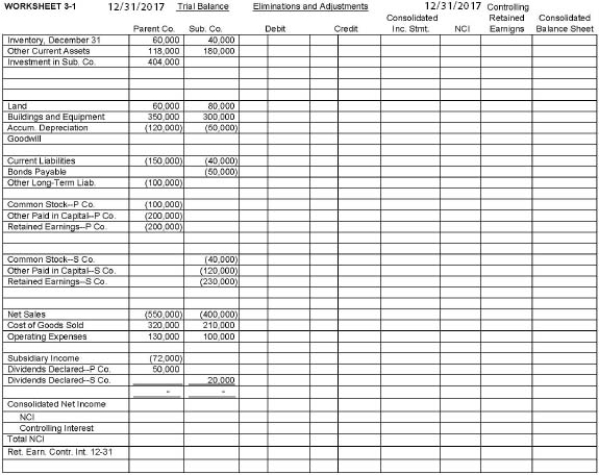

Refer to the information below and Worksheet 3-1.

?

On January 1, 2016, Parent Company purchased 80% of the common stock of Subsidiary Company for $316,000.On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $40,000, $120,000, and $190,000, respectively.Net income and dividends for 2 years for Subsidiary Company were as follows:

?

?

On January 1, 2016, the only tangible assets of Subsidiary that were undervalued were inventory and building.Inventory, for which FIFO is used, was worth $5,000 more than cost.The inventory was sold in 2016.Building, which was worth $15,000 more than book value, has a remaining life of 8 years, and straight-line depreciation is used.Any remaining excess is goodwill.

?

Required:

a.Complete the consolidating worksheet for December 31, 2017.

b.Prepare supportive Income Distribution Schedules for Subsidiary and Parent.

Definitions:

Apple Stock

Shares of ownership in Apple Inc., a multinational technology company known for its electronics and software.

Proprietorship

A form of business organization owned by a single individual who is responsible for its debts and entitled to its profits.

Personal Tax Rate

The percentage at which an individual's income is taxed by the government.

Limited Liability

A legal structure that limits the financial liability of company owners to the amount they have invested in the company.

Q8: In a hedge of a forecasted transaction,

Q8: Call centre jobs are not characterized by

Q14: What is the Solidarity Fund?<br>A) A fund

Q18: On 6/1/17, an American firm purchased

Q18: L & S have invested $80,000 and

Q26: Plateau Company acquires an 80% interest

Q29: Jones Company acquired Jackson Company for $2,000,000

Q36: Plant Company owns 80% of the common

Q37: Company P acquired 60% of the

Q69: Happ, Inc.agreed to purchase merchandise from