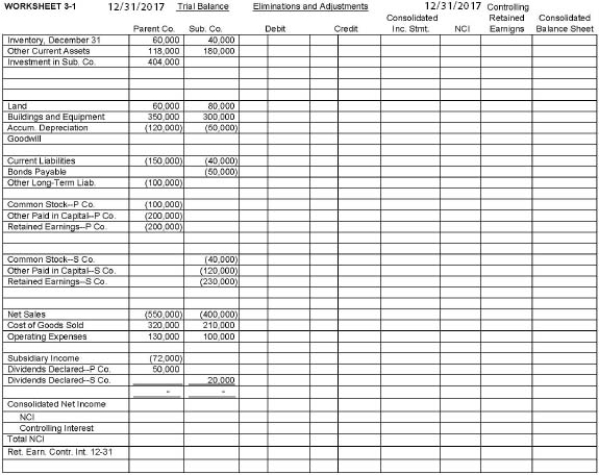

Refer to the information below and Worksheet 3-1.

?

On January 1, 2016, Parent Company purchased 80% of the common stock of Subsidiary Company for $316,000.On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $40,000, $120,000, and $190,000, respectively.Net income and dividends for 2 years for Subsidiary Company were as follows:

?

?

On January 1, 2016, the only tangible assets of Subsidiary that were undervalued were inventory and building.Inventory, for which FIFO is used, was worth $5,000 more than cost.The inventory was sold in 2016.Building, which was worth $15,000 more than book value, has a remaining life of 8 years, and straight-line depreciation is used.Any remaining excess is goodwill.

?

Required:

a.Complete the consolidating worksheet for December 31, 2017.

b.Prepare supportive Income Distribution Schedules for Subsidiary and Parent.

Definitions:

Completed Suicides

Instances in which attempts to take one's own life result in death.

Suicidal Ideation

Thoughts about killing oneself.

Suicide Rate

The number of suicides occurring among a specific population group during a certain period of time.

European Americans

Individuals in the United States who identify with or are descended from European ancestry.

Q4: Which of the following statements about consolidation

Q7: Which of the following foreign currency transactions

Q8: In a hedge of a forecasted transaction,

Q13: Pesto Company paid $10 per share to

Q18: In the 1990s, Canadian industrial relations were

Q22: The Quebec Federation of Labour is the

Q32: Which of the following has helped to

Q35: A parent company owns 80% of

Q40: Blue & Green, Inc.sold merchandise for

Q46: The purchase of outstanding subsidiary bonds by