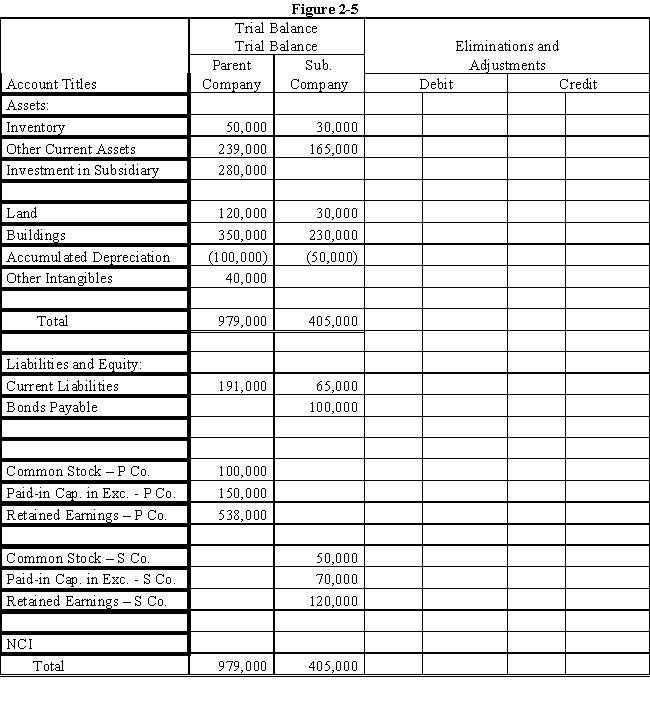

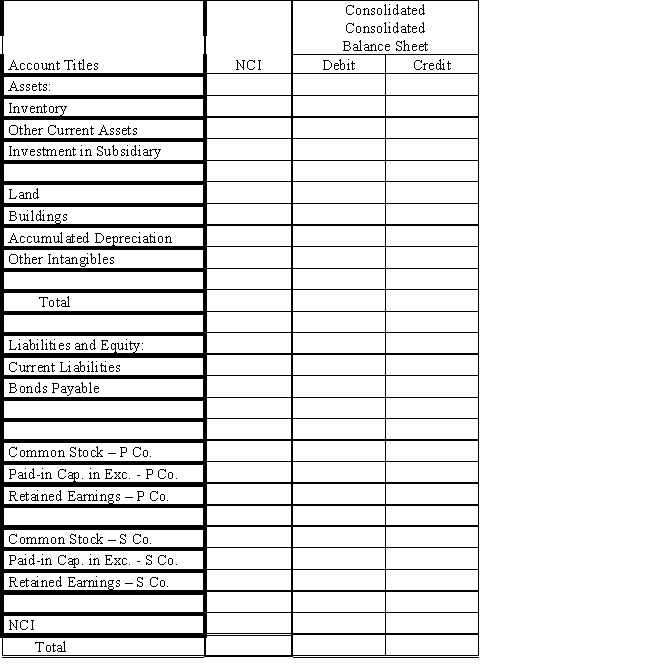

On January 1, 2016, Parent Company purchased 100% of the common stock of Subsidiary Company for $280,000.On this date, Subsidiary had total owners' equity of $240,000.

?

On January 1, 2016, the excess of cost over book value is due to a $15,000 undervaluation of inventory, to a $5,000 overvaluation of Bonds Payable, and to an undervaluation of land, building and equipment.The fair value of land is $50,000.The fair value of building and equipment is $200,000.The book value of the land is $30,000.The book value of the building and equipment is $180,000.

?

Required:

?

a.Using the information above and on the separate worksheet, complete a value analysis schedule

?

?

b.Complete schedule for determination and distribution of the excess of cost over book value.?

?

c.Complete the Figure 2-5 worksheet for a consolidated balance sheet as of January 1, 2016.?

?

?

?

Definitions:

Insured

The individual or entity covered by an insurance policy, which provides protection against loss or damage.

Insurer

An entity that provides insurance coverage, assuming the risk of loss from an insured party in exchange for premiums paid.

Brokers

Intermediaries that arrange transactions between buyers and sellers for a commission.

Loss

A reduction in value, particularly referring to finances, such as money, or other assets.

Q3: For a hedge on an exposed position,

Q6: RWB Corporation, a U.S.based company, bought inventory

Q6: What is the least likely course of

Q6: Discuss some of the most visible 21<sup>st</sup>

Q17: Balter Inc.acquired Jersey Company on January

Q27: When the new partner invests some intangible

Q34: Kidney Company has a wholly-owned foreign subsidiary

Q36: On January 1, 2018, Paul Company purchased

Q40: Dividends paid by a subsidiary have the

Q45: What labour body represents workers' interests to