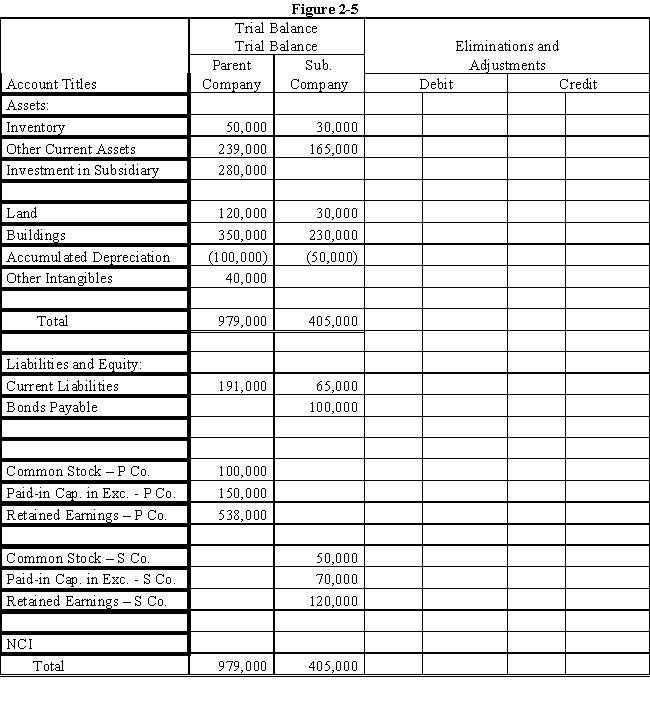

On January 1, 2016, Parent Company purchased 100% of the common stock of Subsidiary Company for $280,000.On this date, Subsidiary had total owners' equity of $240,000.

?

On January 1, 2016, the excess of cost over book value is due to a $15,000 undervaluation of inventory, to a $5,000 overvaluation of Bonds Payable, and to an undervaluation of land, building and equipment.The fair value of land is $50,000.The fair value of building and equipment is $200,000.The book value of the land is $30,000.The book value of the building and equipment is $180,000.

?

Required:

?

a.Using the information above and on the separate worksheet, complete a value analysis schedule

?

?

b.Complete schedule for determination and distribution of the excess of cost over book value.?

?

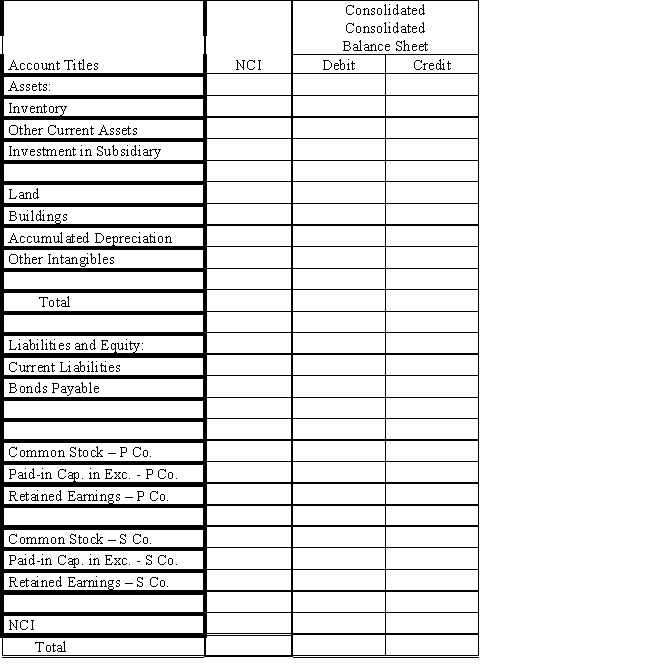

c.Complete the Figure 2-5 worksheet for a consolidated balance sheet as of January 1, 2016.?

?

?

?

Definitions:

Adjusting to New Experiences

The process through which individuals acclimate to changes in their environment or circumstances.

Negative Evaluation

The process of critically assessing something in a way that highlights its flaws, drawbacks, or limitations.

Self-Disclose

The act of revealing personal, private, or sensitive information about oneself to others.

High Self-Esteem

A condition of holding oneself in high regard, characterized by positive self-assessment and confidence in one's abilities and worth.

Q5: During an organizing campaign, unions must not

Q13: Powell Company owns an 80% interest in

Q21: During which of the negotiation stages must

Q24: On occasion, there may be representation on

Q24: Company P purchased an 80% interest in

Q25: Explain why Mount Allison University has had

Q38: If a subsidiary's functional currency is not

Q46: While acquisitions are often friendly, there are

Q49: The Planes Company owns 100% of the

Q60: A fair value hedge may include hedges