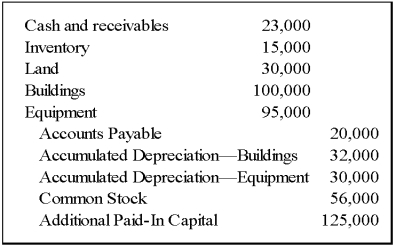

In order to reduce the risk associated with a new line of business, Conservative Corporation established Spin Company as a wholly owned subsidiary. It transferred assets and accounts payable to Spin in exchange for its common stock. Spin recorded the following entry when the transaction occurred:

-Based on the preceding information,what was Conservative's book value of assets transferred to Spin Company?

Definitions:

Ordinary Simple Interest

Interest calculated on the principal amount only, without compounding, over a specific period.

360-Day Year

An accounting convention used for interest calculations where the year is simplified to 360 days to ease the computation process.

Exact Simple Interest

Interest calculated on the principal amount of a loan or investment, considering the exact number of days in the interest period.

365-Day Year

A standard year length used in some financial calculations, ignoring leap years.

Q2: Describe the transaction costs associated with negotiations.

Q4: What are some of the challenges faced

Q21: How are Canada's unions responding to competing

Q27: Based on the preceding information,in the elimination

Q31: Union mergers have been taking place in

Q32: Describe the ratification process.

Q36: Based on the information given above,what amount

Q37: If Push Company owned 51 percent of

Q37: Based on the information given above,what amount

Q55: A certification is considered to be in