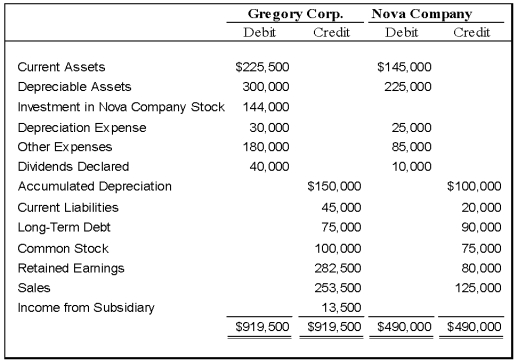

On January 1,20X8,Gregory Corporation acquired 90 percent of Nova Company's voting stock,at underlying book value.The fair value of the noncontrolling interest was equal to 10 percent of the book value of Nova at that date.Gregory uses the equity method in accounting for its ownership of Nova.On December 31,20X9,the trial balances of the two companies are as follows:

Required:

1)Give all consolidating entries required on December 31,20X8,to prepare consolidated financial statements.

2)Prepare a three-part consolidation worksheet as of December 31,20X8.

Problem 49 (continued):

Definitions:

Q1: What happens after the hearing in interest

Q6: On January 1,20X8,Gregory Corporation acquired 90 percent

Q15: In most Canadian labour laws, what is

Q16: Based on the information given above,what amount

Q22: A subsidiary issues bonds.The parent can then

Q22: What role does bargaining power play in

Q29: Pisa Company acquired 75 percent of Siena

Q44: Senior Inc.owns 85 percent of Junior Inc.During

Q47: Based on the preceding information,under the acquisition

Q56: Dividends paid to noncontrolling shareholders:<br>I.are reported as