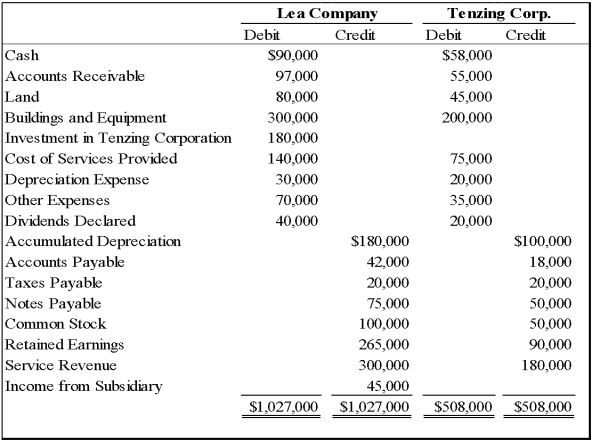

Lea Company acquired all of Tenzing Corporation's stock on January 1, 20X6 for $150,000 cash. On December 31, 20X8, the trial balances of the two companies were as follows:

Tenzing Corporation reported retained earnings of $75,000 at the date of acquisition. The difference between the acquisition price and underlying book value is assigned to buildings and equipment with a remaining economic life of five years from the date of acquisition. At December 31, 20X8, Tenzing owed Lea $4,000 for services provided.

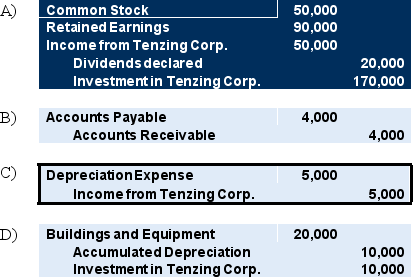

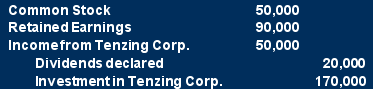

-Based on the preceding information,all of the following are consolidating entries required on December 31,20X8,to prepare consolidated financial statements,except:

Definitions:

Revictimization

The phenomenon where an individual who has experienced victimization once suffers additional episodes, further exacerbating their vulnerability.

Depression

A mental health disorder marked by persistent feelings of sadness, loss of interest, and a lack of energy.

Negative Self-Concept

The perception of oneself in a negative light, often marked by feelings of inadequacy, unworthiness, or lack of self-esteem.

Sexual Harassment

A form of discrimination involving unwelcome sexual advances or conduct, creating a hostile or offensive environment.

Q12: Based on the information given above,what amount

Q20: Which is the only step in the

Q23: What is the term given to legislation,

Q29: On October 1,20X7,Chicago Corporation purchased 6,000 shares

Q30: List and describe the factors affecting the

Q33: Based on the information given above,what amount

Q35: What is the term used to describe

Q36: Based on the preceding information,what amount would

Q47: Discuss the various aspects of the hearing

Q49: Refer to the above information.Assuming Perth's local