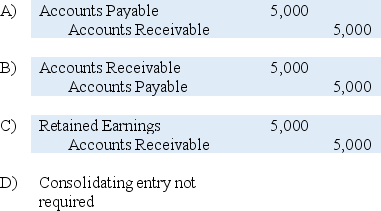

On January 1,20X8,Blake Company acquired all of Frost Corporation's voting shares for $280,000 cash.On December 31,20X9,Frost owed Blake $5,000 for services provided during the year.When consolidated financial statements are prepared for 20X9,which entry is needed to eliminate intercompany receivables and payables in the consolidation worksheet?

Definitions:

Launching Training Programs

The initiation and implementation process of educational or skill development initiatives within an organization.

Strategic Human Resources Management

The proactive management of human resources aligned with the strategic objectives of an organization to gain a competitive advantage.

Evaluation Criteria

Specific standards or benchmarks used to assess the effectiveness or success of a program, project, or individual performance.

Mental Health Training

Educational programs and strategies designed to increase awareness, knowledge, and skills related to mental health and wellness.

Q4: The arbitrator does what at the beginning

Q9: Based on the preceding information,what amount of

Q19: Princeton Company acquired 75 percent of the

Q19: Which party bears the procedural onus in

Q23: Based on the preceding information,the consolidating entry

Q29: Based on the information given,what balance in

Q34: From a union's perspective, a grievance occurs

Q37: It is easy for unions to adapt

Q37: Based on the information given above,what amount

Q73: Based on the preceding information,what is the