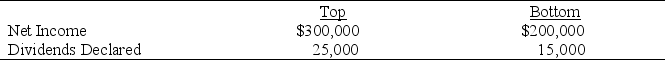

Top Company obtained 100 percent of Bottom Company's common stock on January 1,20X6 by issuing 12,500 shares of its own common stock,which had a $5 par value and a $15 fair value on that date.Bottom reported a net book value of $150,000 and its shares had a $20 per share fair value on that date.However,some of its plant assets (with a 5-year remaining life)were undervalued by $20,000 in the company's accounting records.Bottom had also developed a customer list with an estimated fair value of $10,000 and a remaining life of 10 years.Top Company uses the equity-method to account for its investment in Bottom.During 20X6 Top and Bottom reported the following:

Required:

Prepare each of the journal entries listed below related to Top's investment in Bottom.

1.Top's acquisition of Bottom.

2.Top's share of Bottom's 20X6 income.

3.Top's share of Bottom's 20X6 dividend income.

4.Top's amortization of excess acquisition price.

Definitions:

Diatoms

Microscopic algae with silica shells, playing a crucial role in aquatic ecosystems as primary producers.

Foraminifera

A group of amoeboid protists, characterized by their intricate calcium carbonate shells, important in marine ecosystems and as indicators in the geological record.

Radiolaria

Microscopic planktonic marine organisms with intricate silica skeletons, important in paleoclimate studies.

Trypanosomes

Single-celled parasitic protozoans, known for causing diseases like sleeping sickness in humans and animals.

Q1: What happens after the hearing in interest

Q14: What is the basic concept of the

Q17: Based on the information given above,what amount

Q25: On January 1,20X7,Gild Company acquired 60 percent

Q26: Based on the information given above,what amount

Q46: Based on the preceding information,what amount of

Q49: What is one of the least principled

Q49: Few collective agreements include language to deal

Q55: Based on the information given above,what amount

Q56: Infinity Corporation acquired 80 percent of the