On January 1,20X8,Vector Company acquired 80 percent of Scalar Company's ownership on for $120,000 cash.At that date,the fair value of the noncontrolling interest was $30,000.The book value of Scalar's net assets at acquisition was $125,000.The book values and fair values of Scalar's assets and liabilities were equal,except for buildings and equipment,which were worth $15,000 more than book value.Buildings and equipment are depreciated on a 10-year basis.Although goodwill is not amortized,the management of Vector concluded at December 31,20X8,that goodwill from its acquisition of Scalar shares had been impaired and the correct carrying amount was $5,000.Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders.No additional impairment occurred in 20X9.

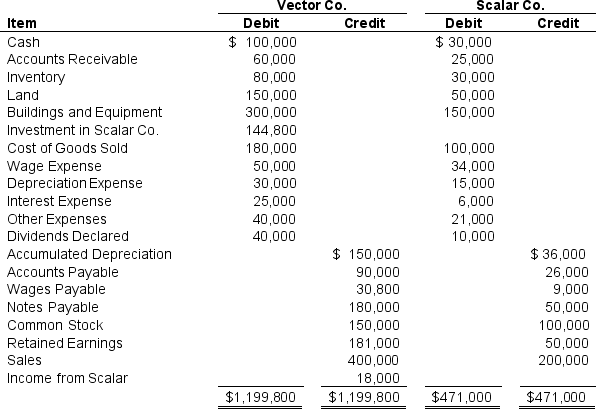

Trial balance data for Vector and Scalar on December 31,20X9,are as follows:

Required:

1)Provide all consolidating entries needed to prepare a three-part consolidation worksheet as of December 31,20X9.

2)Prepare a three-part consolidation worksheet for 20X9 in good form.

Problem 57 (continued):

Definitions:

Town Criers

Historical figures who made public announcements in the streets, often employed by the town or city authorities before the advent of mass communications.

Mississippi River

The second-longest river in North America, flowing southward for 2,320 miles from Minnesota to the Gulf of Mexico, serving as a major transportation and trade route.

Tax-free Markets

Marketplaces or zones where goods and services are sold without the addition of taxes, often to encourage trade or investment.

New Orleans

A major port city located in Louisiana, known for its vibrant culture, music, cuisine, and as the site of Mardi Gras celebrations.

Q3: Based on the information given above,the indirect

Q13: Based on the preceding information,what amount of

Q32: Based on the preceding information,income tax expense

Q32: Based on the preceding information,the amount assigned

Q35: All of the following statements accurately describe

Q36: Based on the preceding information,what is the

Q42: Based on the preceding information,at what amount

Q44: Based on the preceding information,what amount will

Q60: Based on the preceding information,what was the

Q65: Based on the preceding information,what journal entry