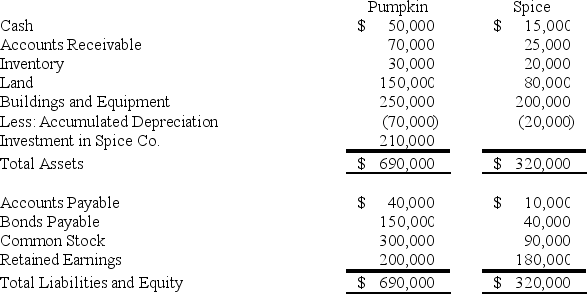

On January 1,20X6,Pumpkin Corporation acquired 70 percent of Spice Company's common stock for $210,000 cash.The fair value of the noncontrolling interest at that date was determined to be $90,000.Data from the balance sheets of the two companies included the following amounts as of the date of acquisition:

At the date of the business combination,the book values of Spice's assets and liabilities approximated fair value except for inventory,which had a fair value of $30,000,and land,which had a fair value of $95,000.

At the date of the business combination,the book values of Spice's assets and liabilities approximated fair value except for inventory,which had a fair value of $30,000,and land,which had a fair value of $95,000.

-Based on the preceding information,what amount of total liabilities will be reported in the consolidated balance sheet prepared immediately after the business combination?

Definitions:

Maximum Capacity

The highest level of output that a company can sustain to make a product or provide a service, under normal conditions.

Dividend Payout Ratio

A financial metric indicating the percentage of a company's earnings paid out to shareholders in the form of dividends.

Debt-Equity Ratio

Calculating a corporation's financial leverage involves dividing total liabilities by the equity of shareholders.

Net Fixed Assets

Net fixed assets refer to the total value of a company's property, plant, and equipment minus depreciation, representing the actual value of company's long-term assets being used in operations.

Q8: What is the purpose of a vote

Q12: Barcode Corporation acquired 70% of the common

Q14: On January 1,2008,Pace Company acquired all of

Q32: Under ASC 805,consolidation follows largely which theory

Q34: Based on the information given above,what gain

Q35: Based on the preceding information,what is the

Q42: What may be the reason for the

Q53: Consolidated net income may include the parent's

Q57: Under the temporal method,which of the following

Q67: Based on the information given above,by what