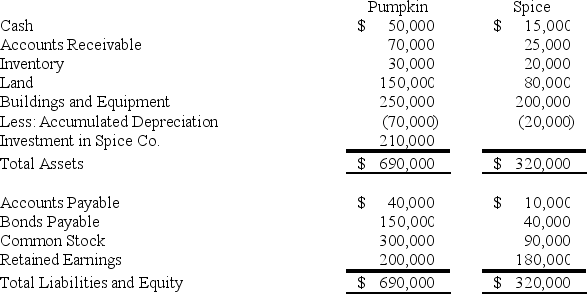

On January 1,20X6,Pumpkin Corporation acquired 70 percent of Spice Company's common stock for $210,000 cash.The fair value of the noncontrolling interest at that date was determined to be $90,000.Data from the balance sheets of the two companies included the following amounts as of the date of acquisition:

At the date of the business combination,the book values of Spice's assets and liabilities approximated fair value except for inventory,which had a fair value of $30,000,and land,which had a fair value of $95,000.

At the date of the business combination,the book values of Spice's assets and liabilities approximated fair value except for inventory,which had a fair value of $30,000,and land,which had a fair value of $95,000.

-Based on the preceding information,what amount will be reported as noncontrolling interest in the consolidated balance sheet prepared immediately after the business combination?

Definitions:

Percentage Form

A way of expressing numbers as a fraction of 100, symbolized by the percent sign (%).

Sticker Price

The full retail price of a vehicle, as displayed on a sticker in the car's window; commonly used to refer to the initial asking price of goods.

GST

The Goods and Services Tax is a form of value-added tax applied to almost all goods and services purchased for use within the nation.

PST

Provincial Sales Tax; a tax levied by certain provinces in Canada on the sale of goods and services.

Q6: What are some initiatives undertaken by unions

Q8: Sphinx Co.(Sphinx)records its transactions in U.S.dollars.A sale

Q8: Park Co.'s wholly-owned subsidiary,Schnell Corp.,maintains its accounting

Q9: Which of the following observations is true

Q14: Based on the preceding information,what amount would

Q14: Discuss the issue of ethnic and racial

Q19: What are the disadvantages of the "total-package

Q24: The Canadian government is reluctant to use

Q30: Based on the preceding information,what amount of

Q42: Based on the information provided,what is the