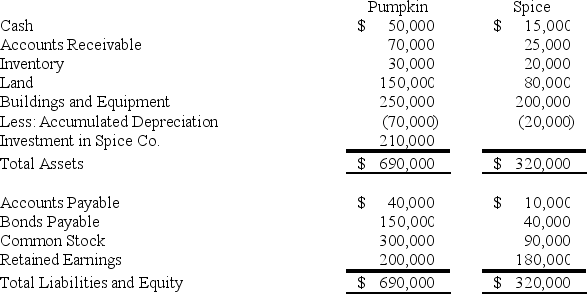

On January 1,20X6,Pumpkin Corporation acquired 70 percent of Spice Company's common stock for $210,000 cash.The fair value of the noncontrolling interest at that date was determined to be $90,000.Data from the balance sheets of the two companies included the following amounts as of the date of acquisition:

At the date of the business combination,the book values of Spice's assets and liabilities approximated fair value except for inventory,which had a fair value of $30,000,and land,which had a fair value of $95,000.

At the date of the business combination,the book values of Spice's assets and liabilities approximated fair value except for inventory,which had a fair value of $30,000,and land,which had a fair value of $95,000.

-Based on the preceding information,what amount of consolidated retained earnings will be reported in the consolidated balance sheet prepared immediately after the business combination?

Definitions:

Capital Budgeting

The process that a business uses to evaluate potential major investment or expenditure projects, using various techniques to determine their value.

Working Capital Management

The supervision of a company's short-term assets and liabilities to ensure its efficient operation and financial stability.

Credit Management

The process of granting credit, setting the terms it's granted on, recovering this credit when it's due, and ensuring compliance with company credit policy.

Borrowing

The act of obtaining funds from another party with the promise of repayment at a later date, often with interest.

Q7: Seattle,Inc.owns an 80 percent interest in a

Q7: On January 1,20X7,Jones Company acquired 90 percent

Q12: Barcode Corporation acquired 70% of the common

Q15: Based on the information given above,what amount

Q22: In order to assess whether successorship exists,

Q29: Locus Corporation acquired 80 percent ownership of

Q31: Based on the information given above,what amount

Q35: Big Company acquired the following assets and

Q45: Based on the preceding information,Selvick Company will

Q45: Which two forms of third-party intervention are