The following information applies to Questions 39-40

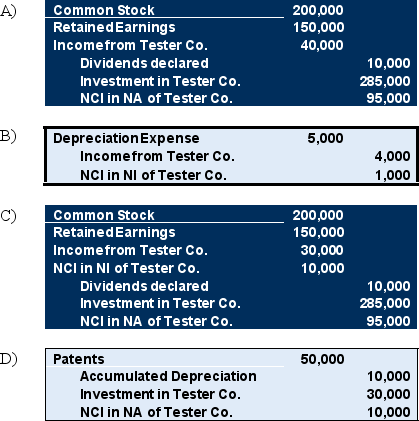

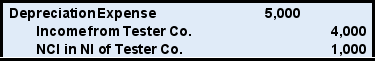

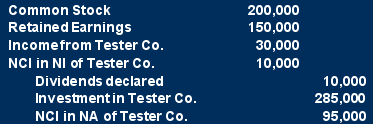

On January 1, 20X8, Ramon Corporation acquired 75 percent of Tester Company's voting common stock for $300,000. At the time of the combination, Tester reported common stock outstanding of $200,000 and retained earnings of $150,000, and the fair value of the noncontrolling interest was $100,000. The book value of Tester's net assets approximated market value except for patents that had a market value of $50,000 more than their book value. The patents had a remaining economic life of ten years at the date of the business combination. Tester reported net income of $40,000 and paid dividends of $10,000 during 20X8.

-Based on the preceding information,which of the following is an consolidating entry needed to prepare a full set of consolidated financial statements at December 31,20X8:

Definitions:

Equivalent Unit

A measure used in cost accounting to represent the amount of work done on partial units of output, making it possible to calculate costs in process costing systems.

Process Costing

A costing method used for homogenous products, where costs are accumulated for a continuous process and then assigned to units of output.

Conversion Costs

The sum of direct labor and manufacturing overhead costs, representing expenses to convert raw materials into finished products.

Curing Department

A specialized area in a manufacturing or production facility where processes such as drying, hardening, or chemical treatment are applied to products.

Q9: Based on the preceding information,what amount of

Q18: Based on the information provided,what amount of

Q22: Boycott Company holds 75 percent ownership of

Q24: Which sections of the cash flow statement

Q34: Based on the preceding information,what is the

Q42: ASC 805 is related to the Consolidation

Q43: Based on the information given above,what amount

Q46: Based on the preceding information,what amount of

Q49: Which of the following stockholders equity accounts

Q56: Based on the information given above,what will