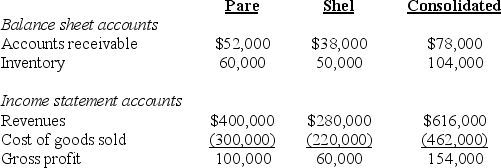

Selected information from the separate and consolidated balance sheets and income statements of Pare, Inc. and its subsidiary, Shel Co., as of December 31, 20X5, and for the year then ended is as follows:

Additional information:

Additional information:

During 20X5, Pare sold goods to Shel at the same markup on cost that Pare uses for all sales.

-What was the amount of intercompany sales from Pare to Shel during 20X5?

Definitions:

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead costs to products based on a planned level of activity or drivers, such as labor hours.

Total Job Cost

The total expenses associated with a specific job or project, including materials, labor, and overhead costs.

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead to products based on a predetermined formula.

Variable Manufacturing Overhead

Costs that vary proportionally with manufacturing activity, such as indirect materials and utilities.

Q1: The types of work and work arrangements

Q6: On January 1,20X8,Gregory Corporation acquired 90 percent

Q6: A statutory consolidation is a type of

Q13: Based on the information given above,what amount

Q18: Based on the information provided,what amount of

Q26: Based on the information provided,what is the

Q31: On June 30,20X0,Bow Corporation incurred a $150,000

Q35: Use the information given,but also assume that

Q38: Based on the information given above,by what

Q60: Park Co.uses the equity method to account