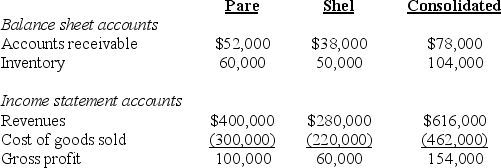

Selected information from the separate and consolidated balance sheets and income statements of Pare, Inc. and its subsidiary, Shel Co., as of December 31, 20X5, and for the year then ended is as follows:

Additional information:

Additional information:

During 20X5, Pare sold goods to Shel at the same markup on cost that Pare uses for all sales.

-In Pare's consolidating worksheet,what amount of unrealized intercompany profit was eliminated?

Definitions:

Activity-Based Costing

A pricing approach that allocates overhead and indirect expenses to distinct activities, resulting in more precise costing for products or services.

Customer Support

Services provided to customers to help resolve issues, answer questions, and ensure satisfaction with a company's products or services.

Time-Driven

An approach where processes or decisions are based on specified durations or schedules, often to improve efficiency or productivity.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific products or services based on their use of activities, improving costing accuracy.

Q16: Explain the term 'abandonment of bargaining rights'.

Q19: Detroit based Auto Corporation,purchased ancillaries from a

Q19: On January 1,20X1,Poe Corp.sold a machine for

Q25: Based on the information provided,what amount was

Q28: Based on the preceding information,in the consolidation

Q32: Based on the preceding information,the amount assigned

Q33: The British subsidiary of a U.S.company reported

Q40: Based on the preceding information,what is the

Q52: Based on the preceding information,the increase in

Q59: Based on the preceding information,which of the