The following data applies to Questions 1 - 3:

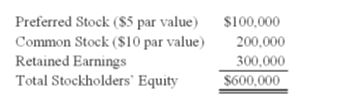

On January 1, 20X9, Company A acquired 80 percent of the common stock and 60 percent of the preferred stock of Company B, for $400,000 and $60,000, respectively. At the time of acquisition, the fair value of the common shares of Company B held by the noncontrolling interest was $100,000. Company B's balance sheet contained the following balances:

For the year ended December 31, 20X9, Company B reported net income of $100,000 and paid dividends of $40,000. The preferred stock is cumulative and pays an annual dividend of 10 percent.

For the year ended December 31, 20X9, Company B reported net income of $100,000 and paid dividends of $40,000. The preferred stock is cumulative and pays an annual dividend of 10 percent.

-Based on the preceding information,the consolidating entry to prepare the consolidated financial statements for Company A as of December 31,20X9 will include a credit to noncontrolling interest in net income of Company B for:

Definitions:

Reserve Price

The minimum price a seller is willing to accept for an item being sold at auction.

English Auction

A type of auction in which the price ascends as participants sequentially bid higher prices until only one bidder remains, who wins the item.

Reserve Price

This is the minimum price a seller is willing to accept for an item in an auction.

Profit-Maximizing

A strategy or process aimed at increasing a company's profits to the highest possible level.

Q17: On July 1,20X4,Denver Corp.purchased 3,000 shares of

Q18: Based on the information given above,what was

Q31: Based on the preceding information,what will be

Q42: Based on the preceding information,what amount of

Q44: Corporation X has a number of exporting

Q49: Assume that the replacement did not happen

Q51: On December 1,20X8,Denizen Corporation entered into a

Q54: Parent Company owns 70% of Son Company's

Q66: Refer to the information provided above.Erin directly

Q75: Tuttle Company discloses supplementary operating segment information