Company A holds 70 percent of the voting shares of Company B. During 20X8, Company B sold land with a book value of $125,000 to Company A for $150,000. Company A continues to hold the land at the end of the year. The companies file separate tax returns and are subject to a 40 percent tax rate. Assume that Company A uses the fully adjusted equity method in accounting for its investment in Company B.

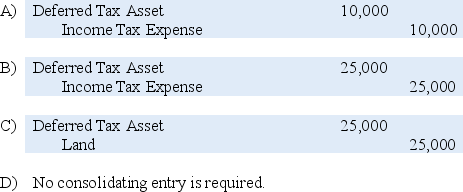

-Based on the information given,which consolidating entry relating to the intercorporate sale of land is to be entered in the consolidation worksheet prepared at the end of 20X8?

Definitions:

Sum Certain

A specified amount agreed upon within a contract that is clear and not subject to change.

Negotiable Instrument

A document guaranteeing the payment of a specific amount of money, either on-demand or at a set time.

Payable on Demand

A financial term indicating that a debt or other financial obligation is due for payment immediately or whenever the creditor requests it.

Time of Payment

The specific period or date by which payment for goods or services is due or expected.

Q1: Based on the preceding information,what amount should

Q7: Based on the preceding information,Trevor Company's net

Q11: Maple Corporation and its subsidiary reported consolidated

Q24: Which of the following forms is the

Q33: Based on the preceding information,the increase in

Q36: All of the following funds have a

Q37: In cases of operations located in highly

Q54: Parent Company owns 70% of Son Company's

Q66: Which of the following funds should use

Q68: In the JAW partnership,Jane's capital is $100,000,Anne's