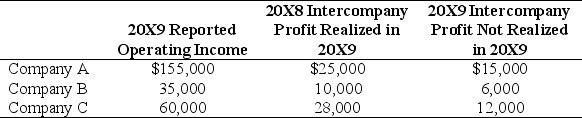

Company A owns 85 percent of Company B's stock and 80 percent of Company C's stock. All acquisitions were made at book value. The fair values of noncontrolling interests at the time of acquisition were equal to the proportionate share of the book values of the companies. The companies file a consolidated tax return each year and in 20X9 paid a total tax of $112,000. Each company is involved in a number of intercompany inventory transfers each period. Information on the companies' activities for 20X9 is as follows:

Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

-Based on the information provided,what amount of income tax expense should be assigned to Company A?

Definitions:

Read

The act of comprehending written or printed material by mentally interpreting and understanding the characters or symbols of which it is composed.

American Literature

Literary work produced in the United States or by American writers, encompassing a wide range of genres and periods.

American Revolution

The conflict between Great Britain’s 13 American colonies and the colonial government, which led to the colonies’ gaining independence and forming the United States of America.

U.S. Literary Celebrity

An American author whose work has gained extensive public attention and fame, often resulting in their becoming a notable figure within the literary culture.

Q24: Current liabilities on the January 2,20X6,consolidated balance

Q26: Refer the information provided above.Assuming the U.S.dollar

Q28: Based on the information given above,what price

Q33: Based on the information given above,what amount

Q34: Based on the preceding information,at what dollar

Q45: Dish Corporation acquired 100 percent of the

Q66: Which of the following funds should use

Q67: Based on the information given above,by what

Q73: Based on the preceding information,in the entry

Q79: Under the modified accrual basis of accounting,revenue