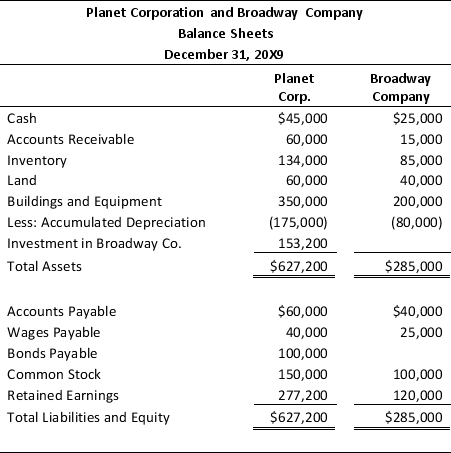

On December 31,20X7,Planet Corporation acquired 80 percent of Broadway Company's stock,at underlying book value.At that date,the fair value of the noncontrolling interest was equal to 20 percent of the book value of Broadway Company.The two companies' balance sheets on December 31,20X9,are as follows:

On December 31,20X9,Planet holds inventory purchased from Broadway for $40,000.Broadway's cost of producing the merchandise was $25,000.Broadway's ending inventory also contains $30,000 of purchases from Planet that had cost it $20,000 to produce.

On December 30,20X9,Broadway sold equipment to Planet for $40,000.Broadway had purchased the equipment for $60,000 several years earlier.At the time of sale to Planet,the equipment had a book value of $20,000.The two companies file separate tax returns and are subject to a 40 percent tax rate.Planet does not record tax expense on its share of Broadway's undistributed earnings.

Required:

1)Prepare the consolidating entries necessary to complete a consolidated balance sheet worksheet as of December 31,20X9.

2)Complete a consolidated balance sheet worksheet as of December 31,20X9.

Problem 57 (continued):

Definitions:

Fixed Expenses

Constant costs incurred by a business, irrespective of the level of goods or services produced.

CVP Graph

A visual representation of the Cost-Volume-Profit analysis that illustrates the relationship between total costs, total sales, and the number of units produced or sold.

Break-even Point

The point where a business's total costs and total revenues are the same, leading to neither a profit nor a loss.

Total Revenue Line

A graphical representation in break-even analysis that shows how total revenue changes with varying levels of sales volume.

Q3: Net income for Levin-Tom partnership for 2009

Q7: Any intercompany gain or loss on a

Q11: Stockholders' equity on the January 2,20X6,consolidated balance

Q23: Based on the information provided,what amount of

Q30: Shue,a partner in the Financial Brokers Partnership,has

Q37: Fox,Greg,and Howe are partners with average capital

Q42: Based on the preceding information,which of the

Q48: Based on the preceding information,what amount of

Q61: Refer to the information provided above.Assume that

Q63: The JKL partnership liquidated its business in