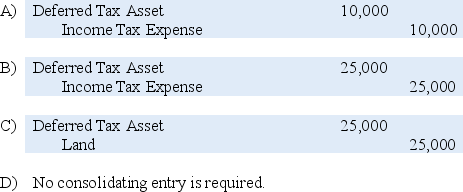

Company A holds 70 percent of the voting shares of Company B. During 20X8, Company B sold land with a book value of $125,000 to Company A for $150,000. Company A continues to hold the land at the end of the year. The companies file separate tax returns and are subject to a 40 percent tax rate. Assume that Company A uses the fully adjusted equity method in accounting for its investment in Company B.

-Based on the information given,which consolidating entry relating to the intercorporate sale of land is to be entered in the consolidation worksheet prepared at the end of 20X8?

Definitions:

Goods

Physical items that are produced and can be bought, sold, or traded.

Sweatshop Labor

Work that is performed in poor conditions for low pay and often violates labor laws.

Working Conditions

The environment, terms, and circumstances under which an individual is employed, including hours, physical aspects, legal rights, and responsibilities.

Tariff of Abominations

The nickname given to the Tariff Act of 1828, which imposed high duties on imports and was highly controversial, particularly in the Southern United States, which felt it economically disadvantaged them.

Q3: Top Corporation acquired 80 percent of Bottom

Q7: Based on the preceding information,Trevor Company's net

Q13: Based on the information given above,what amount

Q15: The following condensed balance sheet is presented

Q18: Collins Company reported consolidated revenue of $120,000,000

Q26: Refer to the information provided above.Using a

Q29: Based on the information given above,what was

Q29: Which of the following accounts could be

Q40: Colton Company acquired 80 percent ownership of

Q55: The Greenpath Corporation's (Greenpath)balance sheet shows assets