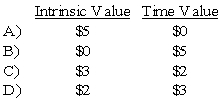

The fair market value of a near-month call option with a strike price of $45 is $5, when the stock is trading at $48.

-Based on the preceding information,which of the following is true of the intrinsic and time values associated with this option.

Definitions:

Gold Futures

Standardized contracts to buy or sell gold at a specified future date and price, used by investors for hedging and speculative purposes.

Long Position

An investment strategy where an investor buys securities with the expectation that they will rise in value over time.

Agricultural Futures

Contracts to buy or sell agricultural commodities at a predetermined price at a specified time in the future, used for hedging or speculating on the price movement of these commodities.

Q5: Based on the information provided,what amount of

Q17: Based on the information provided,what amount was

Q19: Nichols Company owns 90% of the capital

Q20: Power Corporation owns 75 percent of Transmitter

Q22: The Securities and Exchange Commission is responsible

Q22: Quid Corporation acquired 75 percent of Pro

Q26: Based on the preceding information,what is First's

Q29: ASC 280,Disclosure about Segments of an Enterprise

Q32: Which of the following statements concerning the

Q46: Based on the information given above,what balance