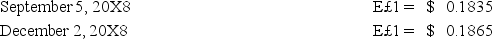

Spartan Company purchased interior decoration material from Egypt for 100,000 Egyptian pounds on September 5,20X8,with payment due on December 2,20X8.Additionally,on September 5,Spartan acquired a 90-day forward contract to purchase 100,000 Egyptian pounds of E£ = $.1850.The forward contract was acquired to manage the exposed net liability position in Egyptian pounds,but it was not designated as a hedge.The spot rates were:

-Based on the preceding information,in the entry made on December 2nd to revalue foreign currency receivable to current equivalent U.S.dollar value,

Definitions:

Internal Cause

A factor or motive originating within an individual or system that contributes to a particular outcome or action.

Distinctiveness

The quality of being easily distinguishable from others due to unique characteristics or features.

Consensus

A general agreement among the members of a group or community, often used in the context of decision-making processes.

Aptitude

A natural ability or skill that makes it easier for a person to learn or excel in a particular area.

Q14: A partner's tax basis in a partnership

Q16: Which of the following accounts are debited

Q21: Based on the preceding information,the amount to

Q25: Orange Corporation owns 70 percent of the

Q29: ASC 280,Disclosure about Segments of an Enterprise

Q29: Based on the preceding information,the amount of

Q35: Based on the preceding information,what amount of

Q40: All of the following stockholders' equity accounts

Q45: Based on the information given,X Company and

Q56: All of the following are true statements