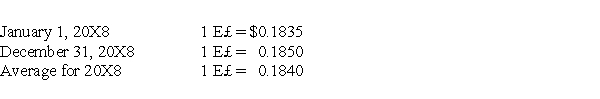

Infinity Corporation acquired 80 percent of the common stock of an Egyptian company on January 1,20X8.The goodwill associated with this acquisition was $18,350.Exchange rates at various dates during 20X8 follow:  Goodwill suffered an impairment of 20 percent during the year.If the functional currency is the U.S.dollar,how much goodwill impairment loss should be reported on Infinity's consolidated statement of income for 20X8?

Goodwill suffered an impairment of 20 percent during the year.If the functional currency is the U.S.dollar,how much goodwill impairment loss should be reported on Infinity's consolidated statement of income for 20X8?

Definitions:

Accrued Expenses Report

A financial document detailing costs that have been incurred but not yet paid for, typically within an accounting period.

Operating Expenses

The costs of running your business, including your rent, utilities, administration, marketing/advertising, employee salaries, and so on.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold in a company, including materials and labor.

Short-Term Portion of Long-Term Debt

The part of a company's long-term debt that is due to be paid within the following twelve months.

Q1: Based on the information given above,what amount

Q3: The general fund of the City of

Q4: During the year a parent makes sales

Q6: Based on the preceding information,the elimination entry

Q9: A limited liability company (LLC):<br>I.is governed by

Q29: Locus Corporation acquired 80 percent ownership of

Q34: Based on the preceding information,what should be

Q42: A debt service fund for the City

Q51: On December 1,20X8,Denizen Corporation entered into a

Q72: Accounting processes differ between a for-profit entity