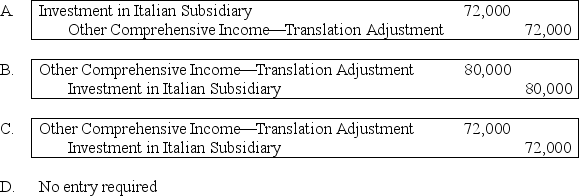

Dover Company owns 90% of the capital stock of a foreign subsidiary located in Italy.Dover's accountant has just translated the accounts of the foreign subsidiary and determined that a debit translation adjustment of $80,000 exists.If Dover uses the fully adjusted equity method for its investment,what entry should Dover record in order to recognize the translation adjustment?

Definitions:

Lithosphere

The rigid outer layer of the Earth, consisting of the crust and the upper part of the mantle.

Rock and Soil Samples

Material collected from the Earth's surface or subsurface for analysis to understand geological and environmental conditions.

Fossil Fuels

Natural resources, such as coal, oil, and natural gas, formed from the remains of ancient plants and animals, used for energy.

Minerals

Naturally occurring, inorganic solid substances with a defined chemical composition and crystalline structure, found in the earth's crust.

Q1: Based on the information provided,what amount of

Q13: Which of the following accounts could be

Q14: Financing for the renovation of Fir City's

Q41: ASC 280 requires certain disclosures about major

Q42: On November 6,20X7,Zucor Corp.purchased merchandise from an

Q45: Based on the information given above,what amount

Q46: The purpose of a "tombstone ad" is:<br>A)

Q48: Based on the preceding information,what amount will

Q50: Based on the information given above,what amount

Q57: The general fund of Athens ordered computer