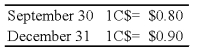

On September 30, 20X8, Wilfred Company sold inventory to Jackson Corporation, its Canadian subsidiary. The goods cost Wilfred $30,000 and were sold to Jackson for $40,000, payable in Canadian dollars. The goods are still on hand at the end of the year on December 31. The Canadian dollar (C$) is the functional currency of the Canadian subsidiary. The exchange rates follow:

-Based on the preceding information,what amount of unrealized intercompany gross profit is eliminated in preparing the consolidated financial statements for the year?

Definitions:

Net Working Capital

An indicator of a firm's immediate financial wellness and liquid assets, determined by subtracting current liabilities from current assets.

Net Working Capital

The financial metric indicating the liquidity position of a firm by subtracting its current liabilities from its current assets.

Operating Cash Flows

Operating Cash Flows refer to the cash generated from a company's regular business operations, reflecting its ability to generate sufficient revenue to maintain and grow operations.

Ending Fixed Asset Value

The residual value of a fixed asset at the end of its useful life or after a specific period.

Q14: Financing for the renovation of Fir City's

Q21: Ridge Company is in the process of

Q23: Based on the information given above,what amount

Q31: Which of the following items are important

Q33: Refer to the information provided above.Allen and

Q36: Based on the preceding information,in the consolidation

Q43: A personal statement of financial condition dated

Q45: Listen and Hear are thinking of dissolving

Q48: Assume Shove sold the inventory to Push.Using

Q73: A joint venture may be organized as