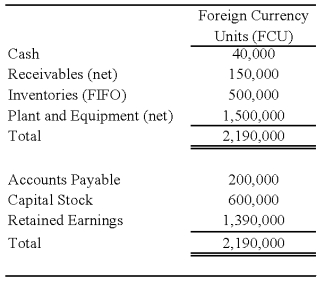

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

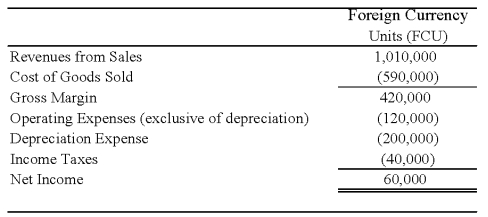

Perth's income statement for 20X8 is as follows:

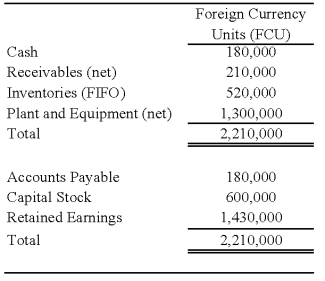

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

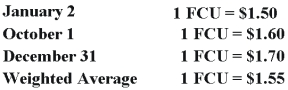

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

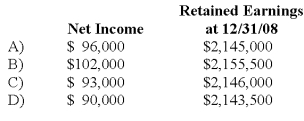

-Refer to the above information.Assuming the local currency of the country in which Perth Company is located is the functional currency,what are the translated amounts for the items below in U.S.dollars?

Definitions:

Marginal Cost

The increase in cost resulting from the production of one additional unit of output.

Advertising Elasticity of Demand

Advertising elasticity of demand quantifies the change in demand for a product as a result of a change in the amount of advertising for that product.

Price Elasticity of Demand

A measure of how much the quantity demanded of a good responds to a change in the price of that good.

Willingness-To-Pay

The maximum amount an individual is ready to spend to purchase a good or service or to avoid something undesirable.

Q3: On the statement of revenues,expenditures,and changes in

Q15: Based on the preceding information,the consolidating entry

Q25: Based on the information given,what is the

Q32: Tyler Company incurred an inventory loss due

Q38: GASB 34 requires a Reconciliation schedule for

Q38: Based on the preceding information,the amount of

Q43: Based on the preceding information,what amount of

Q64: If the functional currency is the local

Q67: Lea Company acquired all of Tenzing Corporation's

Q69: Mazeppa,Inc.is a multinational entity with its head