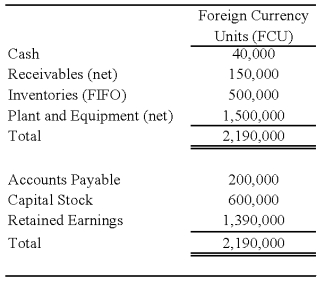

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

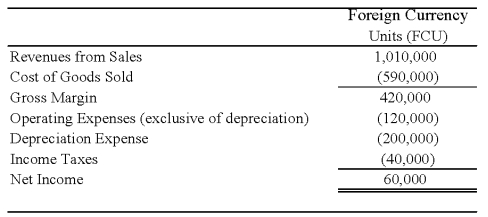

Perth's income statement for 20X8 is as follows:

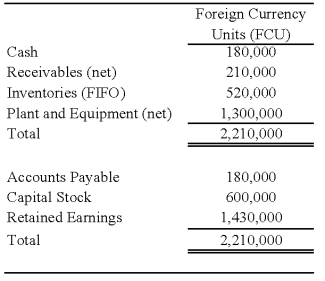

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

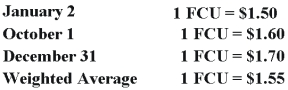

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Perth's local currency is the functional currency,what is the amount of translation adjustments that result from translating Perth's trial balance into U.S.dollars at December 31,20X8?

Definitions:

Solute Gradient

A solute gradient involves the variation of solute concentration across a distance, which can drive various biological processes, including diffusion and osmosis.

Medullary Concentration Gradient

A gradient of solute concentration in the kidney medulla that facilitates water reabsorption and urine concentration through osmosis.

Urea Molecules

Organic compounds and the main nitrogen-containing substance in the urine of mammals, formed in the liver from ammonia and carbon dioxide.

Ascending Limb

The part of the loop of Henle in the nephron that transports fluid from the lower to the upper parts of the kidney.

Q1: On January 1,20X7,Gild Company acquired 60 percent

Q2: Based on the information given above,what amount

Q8: The general fund of Caldwell had the

Q9: Based on the information given above,what amount

Q10: Refer to the above information.If the other

Q21: Based on the preceding information,the receipt of

Q23: Based on the preceding information,what balance would

Q36: Based on the preceding information,what is the

Q43: Which of the following recognition and measurement

Q53: Which of the following observations is true