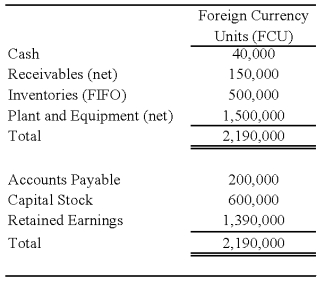

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

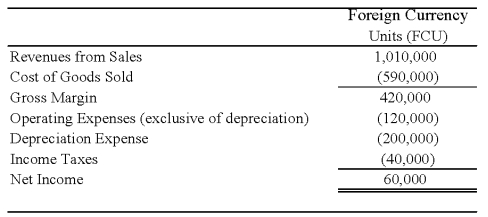

Perth's income statement for 20X8 is as follows:

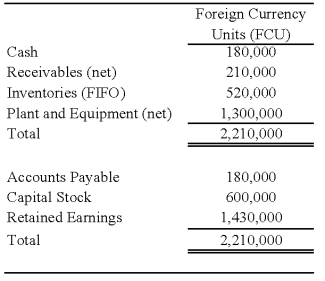

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

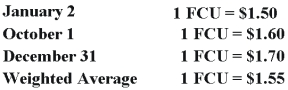

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Perth's local currency is the functional currency,what is the balance in Johnson's investment in foreign subsidiary account at December 31,2008?

Definitions:

Borrowed Money

Funds that are obtained through loans or credits, which must be repaid with interest.

Financing Activities

Transactions and events that affect the long-term liabilities and equity of a company, including issuing debt, issuing equity, and paying dividends.

Cash Flow

The net amount of cash and cash-equivalents being transferred into and out of a business, indicating the organization's liquidity.

Bond Principal

Bond principal, or face value, is the amount that the issuer agrees to pay the bondholder at maturity, excluding any interest payments.

Q2: Based on the information given above,what amount

Q8: Based on the preceding information,the cost of

Q12: When a capital projects fund transfers a

Q25: On November 1,20X8,Denver Company borrowed 500,000 local

Q37: Locus Corporation acquired 80 percent ownership of

Q40: Based on the preceding information,in the preparation

Q42: Based on the preceding information,at what amount

Q56: The general fund of Wold Township ordered

Q61: Refer to the information provided above.Assume instead

Q68: Based on the preceding information,the cost of