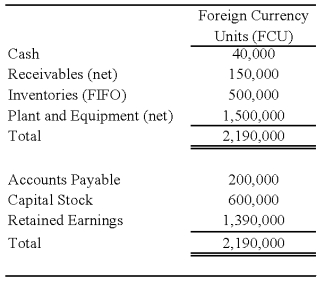

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

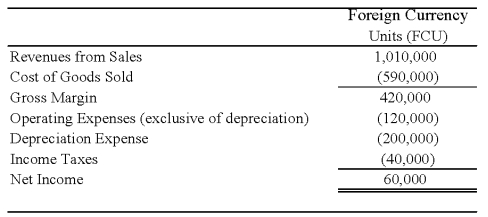

Perth's income statement for 20X8 is as follows:

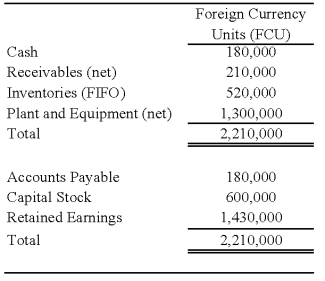

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

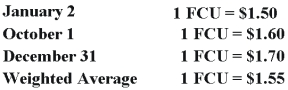

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the amount of Perth's cost of goods sold remeasured in U.S.dollars?

Definitions:

Ackerman Arm

A component of steering linkage systems, it helps control wheel alignment during turns, ensuring effective steering.

Alignment Factors

Variables that influence the proper positioning and adjustment of vehicle components to ensure optimal performance and safety.

Tire Wear

The gradual loss of tread on a tire due to friction with the road surface, affecting grip and safety.

KPI

Key Performance Indicator, a measurable value that demonstrates how effectively an organization is achieving key business objectives.

Q7: Any intercompany gain or loss on a

Q11: Proxy statements are:<br>A) filed by an entity

Q12: The following condensed balance sheet is presented

Q13: Which organization has the authority to establish

Q16: Based on the information provided,what amount of

Q31: Elan,a U.S.corporation,completed the December 31,20X8,foreign currency translation

Q33: Staff Accounting Bulletins

Q34: Based on the information provided,what amount of

Q37: In cases of operations located in highly

Q45: Based on the preceding information,what is the