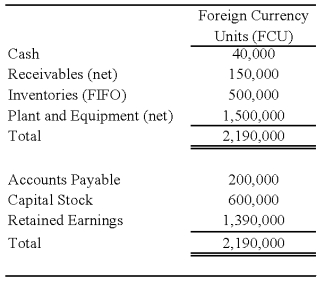

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

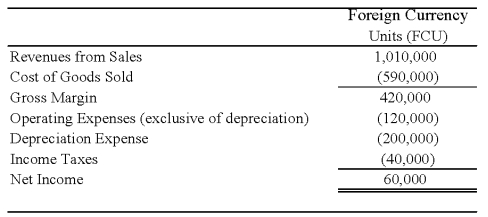

Perth's income statement for 20X8 is as follows:

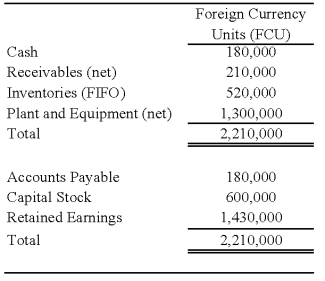

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

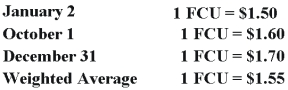

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the amount of patent amortization for 20X8 that results from Johnson's acquisition of Perth's stock on January 2,20X8?

Definitions:

Responsible

Being responsible involves taking accountability for one's actions and fulfilling obligations and duties.

Accountemps

A specialized staffing agency providing temporary and temp-to-hire accounting and finance professionals.

Dependable

Able to be trusted or relied upon; showing reliability and consistency in behavior or performance.

Team Player

A person who works well with others, often prioritizing group goals over personal achievements for the success of the team.

Q2: Based on the preceding information,what is the

Q3: Based on the information given above,what amount

Q17: Mint Corporation has several transactions with foreign

Q22: The Board of Commissioners of Vane City

Q36: The assets listed below of a foreign

Q39: Based on the information given above,what amount

Q57: Chicago based Corporation X has a number

Q61: Which of the following items is optional

Q64: Refer to the above information.On the internal

Q121: Unrestricted current funds of a private university