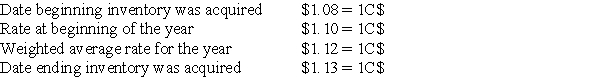

The Canadian subsidiary of a U.S.company reported cost of goods sold of 50,000 C$,for the current year ended December 31.The beginning inventory was 15,000 C$,and the ending inventory was 10,000 C$.Spot rates for various dates are as follows:

Assuming the U.S.dollar is the functional currency of the Canadian subsidiary,the remeasured amount of cost of goods sold that should appear in the consolidated income statement is

Definitions:

Forward Exchange Contract

A financial contract between parties to exchange currencies at a predetermined rate on a specified future date.

Contractual Obligation

A duty or commitment that is legally enforceable due to a contract agreement.

Hedging

A financial strategy used to reduce or manage risk associated with price movements of assets by taking an opposite position in a related security.

Hedging Relationship

A risk management strategy where two or more financial instruments are used together to offset potential losses in investments.

Q1: Based on the information provided,what amount of

Q3: Based on the preceding information,in the consolidating

Q4: Based on the information given above,what amount

Q9: A limited liability company (LLC):<br>I.is governed by

Q18: When is a partnership considered to be

Q22: The Board of Commissioners of Vane City

Q29: Locus Corporation acquired 80 percent ownership of

Q33: Biometric Corporation's revenue for the year ended

Q33: Based on the information given above,what amount

Q34: On a partner's personal statement of financial