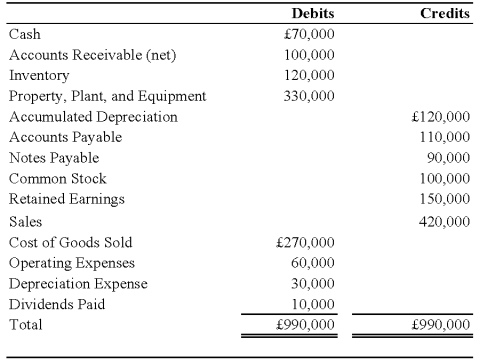

On January 1,2008,Pace Company acquired all of the outstanding stock of Spin PLC,a British Company,for $350,000.Spin's net assets on the date of acquisition were 250,000 pounds (£).On January 1,2008,the book and fair values of the Spin's identifiable assets and liabilities approximated their fair values except for property,plant,and equipment and trademarks.The fair value of Spin's property,plant,and equipment exceeded its book value by $25,000.The remaining useful life of Spin's equipment at January 1,2008,was 10 years.The remainder of the differential was attributable to a trademark having an estimated useful life of 5 years.Spin's trial balance on December 31,2008,in pounds,follows:

Additional Information

1.Spin uses the FIFO method for its inventory.The beginning inventory was acquired on December 31,2007,and ending inventory was acquired on December 26,2008.Purchases of £300,000 were made evenly throughout 2008.

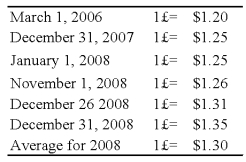

2.Spin acquired all of its property,plant,and equipment on March 1,2006,and uses straight-line depreciation.

3.Spin's sales were made evenly throughout 2008,and its operating expenses were incurred evenly throughout 2008.

4.The dividends were declared and paid on November 1,2008.

5.Pace's income from its own operations was $150,000 for 2008,and its total stockholders' equity on January 1,2008,was $1,000,000.Pace declared $50,000 of dividends during 2008.

6.Exchange rates were as follows:

Assume the U.S.dollar is the functional currency,not the pound.

Required:

1)Prepare a schedule remeasuring the trial balance from British pound into U.S.dollars.

2)Assume that Pace uses the fully adjusted equity method.Record all journal entries that relate to its investment in the British subsidiary during 2008.Provide the necessary documentation and support for the amounts in the journal entries.

3)Prepare a schedule that determines Pace's consolidated net income for 2008.

Problem 75 (continued):

Definitions:

Triumph Over Poverty

Describes the achievement of significant improvement in one's socioeconomic status, overcoming the challenges and limitations imposed by poverty.

Negative Stereotypes

Oversimplified and harmful assumptions about a specific group of people that often contribute to prejudice and discrimination.

Ethnic Group

A community of people who share a common cultural background, heritage, language, or lineage.

Language Development

The process by which individuals acquire the ability to perceive, produce, and use words to communicate effectively, a critical aspect of cognitive and social development.

Q1: On December 31,20X8,Mr.and Mrs.Williams owned a parcel

Q16: Based on the information provided,what amount of

Q16: Which of the following is defined as

Q22: Which of the following statements is (are)true?<br>I.In

Q38: Samuel Corporation foresees a downturn in its

Q44: The following information pertains to Auburn's water

Q52: Transferable interest of a partner includes all

Q53: Based on the preceding information,what would Gulfstream

Q60: The general fund of Battle Creek budgeted

Q63: On July 1,20X8,Cleveland established a capital projects