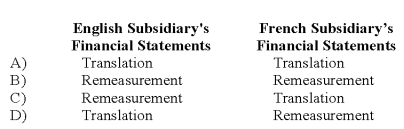

Simon Company has two foreign subsidiaries.One is located in France,the other in England.Simon has determined the U.S.dollar is the functional currency for the French subsidiary,while the British pound is the functional currency for the English subsidiary.Both subsidiaries maintain their books and records in their respective local currencies.What methods will Simon use to convert each of the subsidiary's financial statements into U.S.dollars?

Definitions:

Federal Rules

A set of regulations that govern the process and procedure in the United States federal courts.

Foreign Limited Liability Company

A business entity that is organized in one jurisdiction but is registered to do business in another jurisdiction, offering limited liability protection to its owners.

Law Application

involves the process of applying legal principles and rules to specific situations and cases.

Formed State

A term referring to a specific point in time when a state (in the context of a nation or territory) is officially established or constituted.

Q7: Seattle,Inc.owns an 80 percent interest in a

Q9: Based on the information given above,what amount

Q11: Based on the preceding information,what amount of

Q19: Based on the preceding information,what is the

Q23: Based on the preceding information,what journal entry

Q25: Based on the information provided,what amount was

Q33: On March 1,20X8,Wilson Corporation sold goods for

Q36: All of the following funds have a

Q37: Based on the preceding information,the entries on

Q41: Based on the information given above,what amount