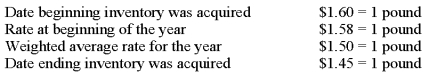

The British subsidiary of a U.S.company reported cost of goods sold of 75,000 pounds (sterling) for the current year ended December 31.The beginning inventory was 10,000 pounds,and the ending inventory was 15,000 pounds.Spot rates for various dates are as follows:  Assuming the pound is the functional currency of the British subsidiary,the translated amount of cost of goods sold that should appear in the consolidated income statement is:

Assuming the pound is the functional currency of the British subsidiary,the translated amount of cost of goods sold that should appear in the consolidated income statement is:

Definitions:

Rental Income

Income received from renting out a property or another asset.

Property Taxes

Levies imposed by a government on a property owner, typically based on the value of the property.

Effective Rate

The actual interest rate an individual pays on a loan or earns on an investment, taking into account the effect of compounding.

Quarterly Compounding

A technique in which interest is computed and then compounded to the main amount quarterly.

Q6: Based on the information provided,the gain on

Q7: Seattle,Inc.owns an 80 percent interest in a

Q15: Refer to the information provided above.Jacob and

Q21: Based on the information given above,what will

Q24: The following information was obtained from the

Q29: Based on the preceding information,the amount of

Q31: A citizen of Minersville purchased a truck

Q31: Based on the information given above,what amount

Q42: Miller and Davis,partners in a consulting business,share

Q43: Based on the preceding information,what amount of