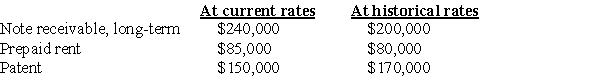

Certain balance sheet accounts of a foreign subsidiary of Rowan,Inc.(Rowan) at December 31,20X6,have been translated into U.S.dollars as follows:

The subsidiary's functional currency is the currency of the country in which it is located.

What total amount should be included in Rowan's December 31,20X6 consolidated balance sheet for the above accounts?

Definitions:

Distribution

The action of sharing something out among a number of recipients, often used in the context of financial assets or dividends.

Transferors Own 80%

A situation in a business transaction where the original owners or transferors retain an 80% ownership interest in the property or entity after the transaction is completed.

Tax-Free

Earnings, income, or transactions that are not subject to tax by the government.

Incorporation

The process of legally constituting a company or corporation, offering protection to owners from personal liability for the company's debts and obligations.

Q8: Park Co.'s wholly-owned subsidiary,Schnell Corp.,maintains its accounting

Q14: Based on the preceding information,what amount would

Q28: Based on the information given above,what price

Q33: Based on the information provided,what is the

Q37: Based on the preceding information,the entries on

Q45: Based on the information provided,in the preparation

Q47: The consolidation treatment of profits on inventory

Q56: On January 1,20X7,Infinity Corporation acquired 90 percent

Q62: Refer to the information provided above.Using a

Q76: On June 30,20X8,String Corporation incurred a $220,000