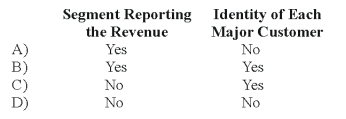

Stone Company reported $100,000,000 of revenues on its 20X8 income statement.During the year ended December 31,20X8,Stone made sales of $8,000,000 to external customers in Western Europe.In addition,Stone made sales of $10,000,000 to the U.S.government and $4,000,000 of sales to various state governments.In the footnotes to its financial statements for 20X8,in reporting enterprisewide disclosures,Stone is required to disclose:

Definitions:

Present Value

The current value of a future amount of money or stream of cash flows, discounted at a specific interest rate.

Capital Lease

A capital lease is a lease classified by the lessee as an asset on its balance sheet, indicating that it effectively has the economic ownership of the asset, even though legally it may not own the asset.

Lease Liability

An obligation representing future lease payments a lessee is required to make under a lease agreement.

Discount Rate

The discount rate applied in calculating the present value of future cash flows during discounted cash flow analysis.

Q18: Dividends of a foreign subsidiary are translated

Q22: Gains from remeasuring a foreign subsidiary's financial

Q24: Based on the information given above,what amount

Q27: Based on the information given above,what was

Q33: Based on the preceding information,what amount will

Q37: Regulation S-X and Regulation S-K:<br>A) govern the

Q41: Based on the preceding information,what was the

Q49: Based on the information provided,what is the

Q71: Based on the preceding information,on Leo's consolidated

Q93: Transaction: Endowment income was earned.The donor placed