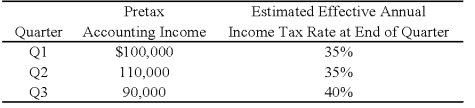

William Corporation,which has a fiscal year ending January 31,had the following pretax accounting income and estimated effective annual income tax rates for the first three quarters of the year ended January 31,20X8:  William's income tax expenses in its interim income statement for the third quarter are:

William's income tax expenses in its interim income statement for the third quarter are:

Definitions:

Iris

The colored ring of muscle around the pupil of the eye, responsible for controlling the size of the pupil and thus the amount of light reaching the retina.

Vitreous Humour

A clear, gel-like substance that fills the space between the lens and the retina in the eyeball, helping to maintain its shape and optical properties.

Cornea

The transparent front part of the eye that covers the iris, pupil, and anterior chamber, contributing to the eye's ability to focus.

Peripheral Vision

The part of vision that occurs outside the very center of gaze, involving the detection of movement and shapes but not detailed images, crucial for spatial awareness and detecting potential hazards.

Q6: Use the information given,but also assume that

Q6: On December 1,20X8,Denizen Corporation entered into a

Q9: The general fund of Richmond was billed

Q11: A newly created subsidiary sold all of

Q17: Based on the information given above,what amount

Q21: All of the following are examples of

Q33: On March 1,20X8,Wilson Corporation sold goods for

Q38: The Canadian subsidiary of a U.S.company reported

Q54: Refer to the above information.Which of the

Q120: For the year ended June 30,20X9,a university