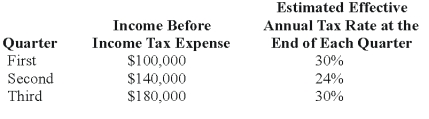

Denver Company,a calendar-year corporation,had the following actual income before income tax expense and estimated effective annual income tax rates for the first three quarters in 20X8:  Denver's income tax expense in its interim income statement for the third quarter should be:

Denver's income tax expense in its interim income statement for the third quarter should be:

Definitions:

Outsourced

The practice of delegating certain job functions or tasks to external contractors or firms, rather than handling them internally.

Business Plan

A formal document that outlines a company's goals, strategies, market analysis, financial forecasts, and operational structures.

Analyze Opportunity

The process of examining potential opportunities to determine their viability and how they can be capitalized on effectively.

Business Plan

A detailed document outlining the strategy, goals, and operational plans for a business to follow for success.

Q9: A private university offers graduate assistantships to

Q10: FASB has specified a "75% percent consolidated

Q14: Financing for the renovation of Fir City's

Q17: Mint Corporation has several transactions with foreign

Q25: Which of the following statements concerning Form

Q25: On November 1,20X8,Denver Company borrowed 500,000 local

Q29: Based on the preceding information,the amount of

Q43: Regulation D of the SEC presents important

Q72: Refer to the information provided above.David invests

Q82: Which of the following items is not