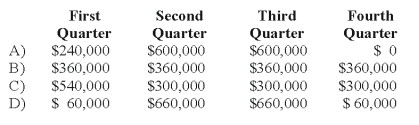

Mason Company paid its annual property taxes of $240,000 on February 15,20X9.Mason also anticipates that its annual repairs expense for 20X9 will be $1,200,000.This amount is usually incurred and paid in July and August when operations are shut down so that machinery and equipment can be repaired.What amount should Mason deduct for property taxes and repairs in each quarter for 20X9?

Definitions:

Q7: For a subsidiary to be eligible to

Q8: What was the amount of intercompany sales

Q21: Based on the preceding information,the receipt of

Q31: Based on the information given above,what amount

Q33: Refer to the information provided above.Allen and

Q35: Based on the information given above,what price

Q35: Based on the preceding information,in the preparation

Q44: Based on the information given above,in the

Q61: Consolidated net income for a parent and

Q63: On July 1,20X8,Cleveland established a capital projects