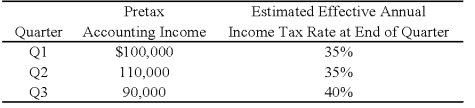

William Corporation,which has a fiscal year ending January 31,had the following pretax accounting income and estimated effective annual income tax rates for the first three quarters of the year ended January 31,20X8:  William's income tax expenses in its interim income statement for the third quarter are:

William's income tax expenses in its interim income statement for the third quarter are:

Definitions:

Pairwise Comparison

A technique used in decision-making and research for evaluating and comparing all pairs in a set of items to determine preferences, rankings, or the significance of differences.

Total Movement

Refers to the complete or aggregate amount of movement, often used in logistics and material handling to describe the flow of goods within a system.

Cycle Time

The total time from the beginning to the end of a process, including processing and waiting times, indicating the speed of production.

Q6: Assume Shove sold the inventory to Push.Using

Q26: The PQ partnership has the following plan

Q28: Which of the following divisions of the

Q34: Based on the information given above,what gain

Q38: Smithtown Distributors acquired Paul's Plumbing on January

Q49: Based on the information provided,what is the

Q66: The capital projects fund of Hysham completed

Q73: Based on the preceding information,what is the

Q73: A joint venture may be organized as

Q94: Clay University,a not-for-profit university,earned $300,000 from bookstore