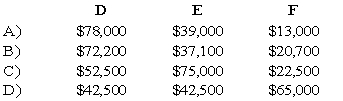

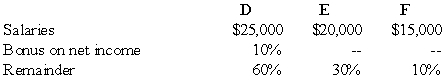

The DEF partnership reported net income of $130,000 for the year ended December 31,20X8.According to the partnership agreement,partnership profits and losses are to be distributed as follows:  How should partnership net income for 20X8 be allocated to D,E,and F?

How should partnership net income for 20X8 be allocated to D,E,and F?

Definitions:

Constructive Comments

Feedback or critique provided in a positive and helpful manner, aimed at improving or enhancing someone's work or behavior.

Team Role

A specific set of behaviors, skills, and responsibilities assigned to an individual within a team to ensure effective collaboration and achievement of common goals.

Adaptive

The quality of being able to adjust to new conditions or environments effectively.

Transferable

Referring to skills, knowledge, or abilities that can be applied in various contexts beyond where they were originally learned.

Q15: Based on the preceding information,the consolidating entry

Q24: The following information was obtained from the

Q25: All of the following are elements of

Q37: In 20X4,Menton City received $5,000,000 of bond

Q46: Healing Angel Hospital,operated by a religious organization,billed

Q50: Bridger Hospital,which is operated by a religious

Q63: Which of the following statements is (are)correct

Q67: Refer to the information given above.What amount

Q76: On June 30,20X8,String Corporation incurred a $220,000

Q83: Under the modified accrual basis of accounting