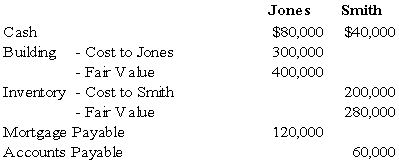

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

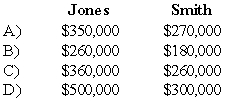

-Refer to the above information.What is each partner's tax basis in the Jones and Smith partnership?

Definitions:

Customer Structures

The organization or arrangement of a company's customer base, typically segmented by needs, demographics, or behaviors.

Product

An item or service created through a process and offered to the market to satisfy a want or need.

Service

The action of helping or doing work for someone, often referring to activities that meet the needs or enhance the well-being of others.

Matrix Structure

An organizational structure that creates dual lines of authority and combines functional and product departments in a single operations framework.

Q2: Based on the information given above,what amount

Q2: The BIG Partnership has decided to liquidate

Q7: On January 1,20X7,Gild Company acquired 60 percent

Q8: The general fund of Caldwell had the

Q10: Based on the preceding information,what is the

Q12: On December 31,20X7,Planet Corporation acquired 80 percent

Q24: The CFO of a "Not-for-Profit" hospital is

Q24: Follett Company incurred a first quarter operating

Q63: The JKL partnership liquidated its business in

Q70: On September 3,20X8,Jackson Corporation purchases goods for