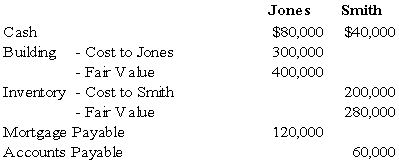

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

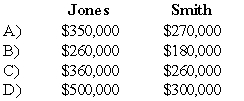

-Refer to the above information.What is the balance in each partner's capital account for financial accounting purposes?

Definitions:

Economics

The social science that studies how individuals, governments, firms, and nations make choices on allocating scarce resources to satisfy their unlimited wants.

Federal Government

The national government of a federated state, which holds the authority to govern at a level above individual states or provinces.

Opportunity Cost

The expense associated with missing out on the second-best choice while deciding among multiple possibilities.

Q2: The following information pertains to revenue earned

Q5: Wilbur Corporation is to be liquidated under

Q24: Based on the preceding information,the elimination entry

Q31: Refer to Exhibit 1.3. What was your

Q43: Due to an error,the general fund of

Q45: Based on the information given above,what amount

Q47: The ABC partnership had net income of

Q52: When the local currency of the foreign

Q53: Based on the preceding information,what would Gulfstream

Q69: Levin company entered into a forward contract