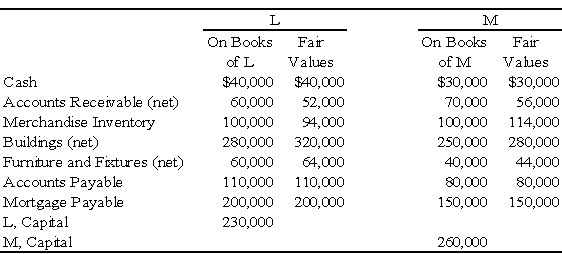

Two sole proprietors,L and M,agreed to form a partnership on January 1,20X9.The trial balance for each proprietorship is shown below as of January 1,20X9.

The LM partnership will take over the assets and assume the liabilities of the proprietors as of January 1,20X9.

Required:

a)Prepare a balance sheet,for financial accounting purposes,for the LM partnership as of January 1,20X9.

b)In addition,assume that M agreed to recognize the goodwill generated by L's business.Accordingly,M agreed to recognize an amount for L's goodwill such that L's capital equaled M's capital on January 1,20X9.Given this alternative,how does the balance sheet prepared for requirement A change?

Problem 72 (continued):

Definitions:

Anxious-Ambivalent Attachment

A type of insecure attachment style characterized by strong emotional dependence on others, mixed with anxiety about their availability and responsiveness.

Interaction

The reciprocal action or influence between entities, leading to a dynamic exchange or influence on outcomes.

Calms Down

The act of becoming less agitated, excited, or angry; returning to a state of peace or tranquility.

Healthier Strategies

Approaches or plans designed to improve or maintain one's health and well-being, typically involving diet, exercise, and lifestyle choices.

Q2: Pro forma disclosures are:<br>A) used to disclose

Q8: "Classification of an endowment contribution" describes which

Q25: Based on the preceding information,what is the

Q31: Based on the information given above,what amount

Q34: The disclosure,"net assets released from restrictions," is

Q42: A debt service fund for the City

Q43: Based on the preceding information,what amount of

Q49: In order to avoid inequalities in the

Q62: Based on the preceding information and assuming

Q83: Transaction: Received tuition revenue from hospital nursing