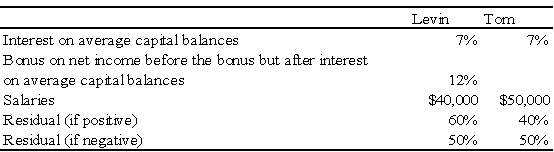

Net income for Levin-Tom partnership for 2009 was $125,000.Levin and Tom have agreed to distribute partnership net income according to the following plan:

Additional Information for 2009 follows:

1.Levin began the year with a capital balance of $75,000.

2.Tom began the year with a capital balance of $100,000.

3.On March 1,Levin invested an additional $25,000 into the partnership.

4.On October 1,Tom invested an additional $20,000 into the partnership.

5.Throughout 2009,each partner withdrew $200 per week in anticipation of partnership net income.The partners agreed that these withdrawals are not to be included in the computation of average capital balances for purposes of income distributions.

Required:

a.Prepare a schedule that discloses the distribution of partnership net income for 2009.Show supporting computations in good form.

b.Prepare the statement of partners' capital at December 31,2009.

c.How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $45,000 to Levin and $60,000 to Jack?

Problem 73 (continued):

Definitions:

Present Value Index

A financial calculation that allows the comparison of the present value of cash inflows to the present value of cash outflows.

Rate of Return

A measure of the profitability of an investment, expressed as a percentage of the original investment.

Desired Rate

A targeted rate of return or performance that a company or individual aims to achieve, often used in financial and operational planning.

Present Value Methods

Techniques used to estimate the current value of future cash flows, discounting them at a specified rate.

Q4: Refer to the information provide above.Erin invests

Q4: Windsor Corporation acquired 90 percent of Agro

Q10: FASB has specified a "75% percent consolidated

Q13: All of the following are benefits the

Q31: On June 30,20X0,Bow Corporation incurred a $150,000

Q33: An individual who selects the investment that

Q35: Barcode Corporation acquired 70% of the common

Q54: On the statement of revenues,expenditures,and changes in

Q56: All of the following are true statements

Q70: On September 3,20X8,Jackson Corporation purchases goods for