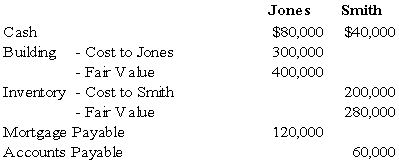

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

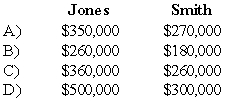

-Refer to the above information.What is each partner's tax basis in the Jones and Smith partnership?

Definitions:

Dietary Restraint

A psychological concept that describes the intention to restrict food intake for the purpose of controlling body weight or fat.

Overeating

The consumption of food in quantities greater than the energy expenditure, often leading to weight gain and potentially contributing to various health issues.

All-or-Nothing

A principle that states the neuron either fires at full strength or it does not fire at all, relating to the action potential in neuroscience.

Affective Forecasting

The process of predicting one’s emotional reactions to future events or outcomes, often with inaccuracies concerning the intensity and duration of emotional responses.

Q2: Refer to Exhibit 1A.1. The standard deviation

Q6: Refer to the information provided above.David invests

Q9: Based on the preceding information,what amount will

Q16: In which of the following ways can

Q24: On September 1,20X1,Brady Corp.entered into a foreign

Q33: A subsidiary issues bonds.The parent can then

Q35: Use the information given,but also assume that

Q36: Griffin and Rhodes formed a partnership on

Q40: Based on the preceding information,which of the

Q47: A private,not-for-profit hospital received the following restricted